A banker, a lawyer, and a Sheikh walk into a bar. What follows is not a joke, but a tale of high-stakes business, intrigue, betrayal, and court cases.

The banker in question is Bashir Tahir – a former BCCI hand that headed one of the largest investment companies in the world that funneled billions of dollars in investments into Pakistan. The banker is Adeel Bajwa, the man that eventually replaced Bashir Tahir as head of the company after the former was unceremoniously ousted.

And the Sheikh is Sheikh Nahayan bin Mubarak Al Nahayan. The Sheikh is a member of the extended royal family of the United Arab Emirates and is currently the Emirates’ Minister for Tolerance. Back in the 1980s, he was the up and comer of the royal family, not entitled to the wealth and power that his second-cousin Khalifa bin Zayed bin Sultan al-Nahayan, the current President of the UAE, was set to inherit.

But cousin Nahayan had other things going for him. For one thing, he had a good education, having managed to graduate from Magdalen College at Oxford University (the same one that has amongst its other alumni, Erwin Schrödinger, Oscar Wilde, and King Edward VIII of England). Nahayan developed a keen eye for business, and would go on to found the Abu Dhabi Group, a loose family association of investments that would go on to pour billions of dollars in many parts of the world, the biggest chunk of which was in Pakistan.

The Abu Dhabi Group would eventually become one of the largest investors in Pakistan. And even as they invested in Africa and Central Asia, Pakistan became Sheikh Nahayan’s playground, and the group’s core asset. It currently owns a controlling stake in Bank Alfalah (Pakistan’s seventh largest bank), the telecom company Wateen (or whatever is left of it), and minority stakes in Jazz (formerly Mobilink, Pakistan’s largest mobile operator), and in United Bank Ltd (Pakistan’s third largest bank), and major real estate projects worth at least several hundred million dollars, if not billions of dollars.

Over the years, the Sheikh would appoint two Pakistanis as chief executives for his group. His first right hand man was Bashir Tahir, and by extension Bashir’s brother Pervez Shahid. For years ‘the brothers’ were flying high, until 2011, when they were forced to exit the group shrouded in mystery and shame. For the next five years, the group would be run by a four-person team of mostly Europeans with some Pakistani input. The Sheikh was also unable to retain their services, firing the entire board in one fell swoop in 2016.

The next Pakistani to be elevated to the top job by the Sheikh was Adeel Bajwa, a lawyer turned investment banker with a similar roller-coaster trajectory. Bajwa assumed the role of CEO after the 2016 board debacle, though his tenure was not to last long. In March 2019, he too was given an honourable discharge, and ‘resigned’ as the group’s main man. He was succeeded by Dominique Liana Russo, the Columbia and MIT-educated former management consultant, and the first woman to hold the job.

The two former favourites of the Sheikh’s have currently pulled up their drawbridges and are hiding behind their castle walls. They are engaged in a messy legal battle over land grabbing as well. It is clear enough that they have a lot to say, both about the group and about the Sheikh himself. But both are reluctant to open up.

In interviews with Profit, Bashir Tahir and persons close to Adeel Bajwa maintained a tact decorum, even when discussing nasty bits like police reports, corruption, and threats. But behind the facade of politeness, there exists an epic triangle of almost Victorian proportions. The Sheikh is the hasty, Byronic hero who believes any and every rumour that the wind carries in – in a word, unreliable. Bashir Tahir and Adeel Bajwa are his spurned confidantes. Embroiled equally in their admiration for the Sheikh, their bitterness at how it ended, and their hatred for each other. And being torn apart in the process is the family heirloom that is the Abu Dhabi Group in Pakistan.

As the Abu Dhabi Group looks to possibly depart from the murky, drama-filled landscape of Pakistan, it could take with it billions of dollars worth of investments from the country. The Punjab government has already tried to mend fences, but has the Sheikh had enough of Pakistan? And if he has, how much of the group’s failure to consolidate is he himself responsible for?

As with anything worth explaining, let us start at the very beginning, and an ominous beginning at that, the Bank of Credit and Commerce International.

Rising from the ashes

If you ever want to see a disaster, you need not look farther than Agha Hasan Abedi and the Bank of Credit and Commerce International (BCCI). The bank’s misdemeanours and Abedi’s life are well recorded and extensively profiled, including by this magazine. But from the disaster of corruption that was the BCCI, there also came out men and women that had given the bank much of their lives and had risen high in its ranks.

One of these men was Bashir Tahir, who had been in the world of banking since the early 1970s, leaving somewhere around 1991, when things at BCCI were really going down the drain. In that year, he was arrested as one of the five high-profile figures from the bank and let go sometime in 1994 after a three-year prison stint. But it was back in the 1980s, when he was still a part of BCCI, that Tahir first interacted with the UAE royal family, to a section of which he would become a central figure in the decades to come.

His first interaction with the Nahayan family was with Mubarak bin Mohammed al-Nahayan, who was then interior minister of the UAE, and the father of our story’s central figure. So, when Mubarak bin Mohammed Al Nahayan, died soon after these initial interactions in a road accident in London, his son came back to the UAE to manage his father’s affairs. And that is where the relationship between Bashir Tahir and the Sheikh began.

At this time, the BCCI was operating in the UAE with two different kinds of branches, both as branches of their bank holding company in Luxembourg, as well as locally incorporated branches. In the UAE, Agha Hasan Abedi decided to set up the Bank of Credit and Commerce Emirates (BCCE), a locally based version of the BCCI. To lead this new venture, he chose Bashir Tahir as his General Manager, a title that belies the importance of the role that he was to play.

BCCI had a 40% stake in this new bank, and the governments of Dubai and Abu Dhabi both had a 10% stake each. The remaining 40% was publicly held. The next decade would see the bank grow under Tahir’s management. It would also, in 1991, change its name to Union National Bank, with Tahir as CEO, to try and distance itself from the unavoidable link with the BCCI, which was nearing its own crash.

But back when the bank was first formed in 1983, there had been one fateful decision Abedi had made, and Tahir had unwittingly helped him make. With the forming of the new bank, there had come the issue of appointing a Chairman. The name that came to Bashir Tahir’s mind was of the young, Oxford-educated, suave, sharp-minded Sheikh Nahayan. Having interacted with the son of his former acquaintance, Tahir pitched his name to Agha Hasan Abedi who appointed him Chairman of the BCCE. This was the beginning of a close professional relationship between Bashir Tahir and the Sheikh.

The beginnings

By the time BCCE, which had become the UNB by then, collapsed under the weight of the crimes of the BCCI and Abedi, Tahir had already left the bank, been jailed, freed and was in the short wilderness period of his career. It was during this that Sheikh Al Nahayan, seemingly unworried over his time in the slammer, called him up to be the Abu Dhabi Group’s CEO.

“This was actually just called the Dhabi Group. We called it ‘Abu Dhabi Group’ to give it more credibility since people recognised the area,” Tahir said, alluding to the fact that many Pakistanis often mistake the Abu Dhabi Group as being a UAE government-owned entity (it is not).

Profit interviewed Tahir in his drawing room, decorated lavishly to the point of being gaudy. Bashir Tahir is by no means a man with a loud personality or a striking presence. He is of average height and build and a low voice lowered even more by age.

But in the middle of the gaudy décor, he exudes a sort of simplicity in his creamish kurta shalwar – a man who appreciates afternoon naps and warm cups of milk. He does not seem, at least in physical appearance, anywhere near what you would imagine a person in the cut-throat upper echelons of the world of business to be. Whether retirement has done this to him or age, he appears a tame figure.

The Abu Dhabi Group was a loose family association of investments. It was conservative in its investment outlook, and not really very well-known around the world. That would all change once the Sheikh appointed his Pakistani associate as the group’s CEO.

From a family office engaged primarily in passive investments, Tahir would transform the al-Nahayan family’s investments into a vehicle that acted as a lead investor for a consortium of investors that came to be known as the Abu Dhabi Group. The key focus areas became banking, telecommunications, and real estate. The group’s plan of action was to invest in places where other investors would fear to tread.

“The Group understood the risks of investing in emerging and frontier markets, including corrupt government officials and corruption in general. However, we were able to manage the risks inherent with this investment approach by approaching each target market as a portfolio investor,” he explains.

Unlike what many people may think, Bashir Tahir was not the Abu Dhabi Group’s man in Pakistan. He was the man for the entire Abu Dhabi Group. The Sheikh had him flying all over the world, including Africa and other underdeveloped regions to invest the group’s money.

“But as a Pakistani, my heart naturally gravitated towards my own country. In addition to this, the Sheikh himself was very deeply interested in the possibilities Pakistan had to offer, a place his grandfather had once called his second home.”

According to his own estimate, Bashir Tahir was directly responsible for bringing in a whopping $3 billion in investments to Pakistan alone. By comparison, the investments he was responsible for in the rest of the world totaled only $500 million.

Bashir Tahir himself was headquartered in the UAE, close to the Sheikh, at his beck and call whenever he needed financial advice on investment matters.

At its peak, the Abu Dhabi Group’s investments globally included Bank Alfalah, United Bank Ltd (sold soon after being bought), Warid Telecom (Pakistan, Bangladesh, Republic of Congo, Uganda & Georgia), Wateen Telecom, KOR Standard Bank (Georgia), Raseen Technologies, Al Razi Healthcare, and other investments in the industrial, pharmaceutical and consumer staples sectors.

But where it all started was Bank Alfalah. And its buying in difficult conditions and eventual rise as one of the top five banks in Pakistan was orchestrated by Bashir Tahir, with help from his younger brother Pervez Shahid.

The expansionary period

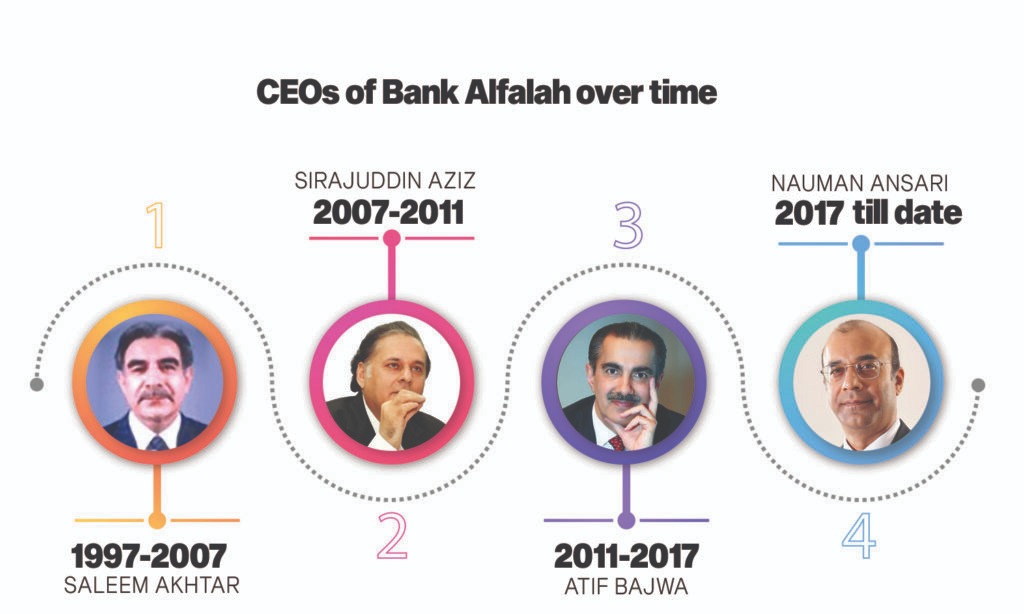

Bank Alfalah started off with the remnants of BCCI in Pakistan. After the scandal that surrounded Abedi, the Pakistan government had bought out the three branches of the bank that had existed in Pakistan. In 1997, on the advice of Bashir Tahir, Sheikh Nahayan bought those three branches and made his first inroads into Pakistan.

And while he sat next to the Sheikh in the UAE, Pervez Shahid worked as the strategic manager for Bank Alfalah, playing a crucial role in the bank growing from its original three branches to having coverage all over the country, and eventually a small presence in Afghanistan and Bangladesh as well. By 2010, the last full year of Tahir’s tenure at the group, the overall count became 378 branches in Pakistan, two in Afghanistan and five in Bangladesh.

Soon after Bank Alfalah was established in 1997 the Sheikh might have thought twice about his recent investment given the military coup in October 1999 that brought General Musharraf to power. The instability in the country, however, did not deter Bashir Tahir, who doubled down and had perhaps his best days during the Musharraf era.

Bank Alfalah continued to grow, and when it opened its flagship branch in the historic Shahdin Manzil in front of the Punjab Assembly, in attendance at the inauguration was none other than President Pervez Musharraf.

He also formed a close association with the Pakistan Muslim League Quaid (PML-Q) administration in Punjab, and with the Chief Minister Chaudhry Pervez Elahi. Pictures of Bashir Tahir receiving the Sitara-e-Imtiaz from President Musharraf or sharing a laugh with Elahi line the walls and many nooks and crannies in his house.

In 2002, the Abu Dhabi Group had been part of the consortium that had been involved in buying United Bank Ltd from the government of Pakistan after its privatisation. The Sheikh would serve as the Chairman of UBL for the next 11 years, as the brothers continued to try and get an iron grip on Pakistan’s banking.

At the same time, the group looked to expand into other territories and sectors within Pakistan. Perhaps the most significant of these moves were Wateen and Warid – the former of which is currently facing the doldrums, and the latter has been merged with Jazz. But it was here that our other character makes his first appearance, and stakes his claim for the Sheikh’s trust.

Enter Adeel Bajwa

In 2004, Adeel Bajwa was on a flight back to Pakistan. He was a disappointed man, having failed to finish the job he had been assigned. His employer, the late Salman Taseer, had sent him as legal counsel to take part in the auction of 2G licences for Pakistan. Salman Taseer’s group did not get the license, but on the flight back with him were Bashir Tahir and Pervez Shahid, already entrenched titans in the imagination of Pakistani business aspirants.

So when Bashir Tahir offered him a job with the Abu Dhabi Group, he took it without thinking twice. All of Salman Taseer’s persuasion and displeasure were not enough to stop him, and soon enough he was taking the daily elevator to the 9th floor of the EFU buildings in Lahore where he worked as legal counsel to Warid and Wateen.

Telecom is a complicated business from a regulatory perspective, and good lawyers are important for the business. Licenses are a messy, legal affair and there are few that can really go through the mind-numbing process of understanding the nitty gritty details of it all. Adeel Bajwa became that man for the Abu Dhabi Group.

So much so that when the group’s telecom interests in Bangladesh were under threat in 2005-06 due to a snag in getting licences for 900-level spectrum frequencies, he was the man they sent overseas to deal with it. Tagging along with him was Pervez Shahid, and the two spent six months in Dhaka together and were ultimately successful in resolving the problem.

The next few years were a period of growth for the Abu Dhabi Group, the brothers, and for Adeel Bajwa. Bajwa was still not quite at the top, so to speak, but he was making his ascent. After his success in Bangladesh, he was sent all over Africa to deal with the group’s desire to acquire telecom licenses in the continent, becoming the go-to person for the Sheikh on all matters telecom.

In Uganda and Congo, there were attempts on his life when the Sheikh insists on disrupting the telecom markets in countries where the industry was consolidated in the hands of powerful local individuals and companies. He also went to Georgia, where he was responsible for the acquisition of the Kor Standard Bank (now Terabank).

In an interview, persons close to Adeel Bajwa tell of his dedication and his single minded work ethic. A commonly quoted example is a night he spent in Georgia to work on a bank acquisition. The story goes that the still wet behind the ears lawyer was excited boarding a plane going to the European sounding ‘Georgia.’ But as it turned out, it was a straight shuttle from the airport to the hotel, working all night on the contract, getting the job done and flying straight back to start another day. But his work shone through, and Bajwa slowly but surely started becoming an important cog in the Dhabi machine.

At some point during all this, Bajwa was moved to Abu Dhabi. He became the General Counsel to the group. His involvement in affairs back in Pakistan was now limited only to the legal side of Warid and Wateen, both of which he had taken a lead in.

For a short period, things seemed in order. Bashir Tahir was soaring high, trusted and relied upon by the Sheikh. In 2006, he had once again used his influence with the Sheikh and his good terms with the Punjab government and Chief Minister Pervez Elahi to kickstart the remarkable real estate investment project known as Taavun.

The Abu Dhabi Group was also building a huge building on Ferozpur Road in Lahore worth billions of rupees. Adeel Bajwa had also found his little niche within the group. But things were about to change drastically, as the brothers finally began their plummet from the top.

The chinks in their armour were starting to become apparent. At the end of the Musharraf Administration in 2008, Pakistan seemed a less desirable business destination for foreign investors like Sheikh Nahayan. The political rivalry between the Sharifs – now back in office in Punjab – and the Elahis, now on the outside, began to affect the group.

While the Shehbaz Sharif administration in Punjab also wanted the Abu Dhabi Group’s investment dollars, their desire to punish all those close to the Elahi administration was enough for them to halt government approvals for some of the Abu Dhabi Group’s projects.

Other pet projects for the group included Al Razi Healthcare, the diagnostic facility that the Dhabi group was trying to bring in competition against giants such as Chughtai. But after building a single diagnostic center somewhere in Gulberg, the Sheikh did not want to put in more money even as other players were investing, growing and bullying market space away from the group. A sugar mill in Sindh that the Sheikh invested in privately apart from the group saw the same end, a dearth of investment.

At the same time, Wateen was also beginning to falter. Once the hot internet provider on the market, it now faced the same existential problem: the Sheikh did not want to put in any money after having set it up. His expectation was a quick pay day, not the many labours that building industry takes.

According to whispers at the time, Wateen had become a shining example of bad management under the brothers and it’s then CEO Tariq Malik. What they do not take into account is that Wateen by this point had become an uphill battle. Telecom is a rapidly changing business, new technology can wipe out existing infrastructure overnight. The key is to keep investing and wait until the moment is ripe to cash out. This is where the Sheikh failed, simply because he was no longer interested in pouring more money into Wateen and Warid as well. The oversubscribed IPO of Wateen at Rs 10 per share in 2010 and its subsequent buyback and delisting at Rs 4 per share continues to haunt investors till date.

Despite this, the brothers continued on their aggressive investment spree, unhindered by not having the same sort of government support as before. The result was a catastrophic fall from grace, and in the Sheikh’s eyes.

The crash

Uneasy lies the head …, as they say. Particularly uneasy were the heads of the brothers, as Bashir Tahir and Pervez Shahid had come to be known. And uneasy as they were, their heads were about to roll as the Sheikh went on his first royal clean-up spree in the group.

In 2011, Members Board of Directors, Warid Tel and Wateen Telecom, Bashir A Tahir and Pervaiz A Rashid had resigned from both the companies. The Abu Dhabi Group had by then invested over a billion dollars in the telecom and banking sector. When the news initially broke, Tahir said he had resigned for personal reasons. But a major reshuffle, especially in Wateen, was on the cards, especially since its CEO Tariq Malik had also resigned, and a man from Abu Dhabi was already being sent down to assess the damage.

The Sheikh and the brothers were at odds. Wateen was bleeding money, and the only solution to stop the gush was putting up more money. The Sheikh seemed disinterested, but this did not fit well with the expansionary methods of the brothers, and Wateen was bleeding a million dollars a month just on its WiMax business. At the same time, before and after Tariq Malik, teams at Wateen came and went with the wind, not letting the company take root at all.

In the middle of this internet disaster for the ages, which has led Wateen to a point where they are barely able to pay for their employees, and not at all able to even pay their utility bills, there were also personal allegations against the brothers. The allegations against Tahir and Pervez have always been hazy. But at some point there was the feeling that somewhere there were financial discrepancies. Whispers flew that the brothers had rented and leased their own properties to Bank Alfalah at exorbitant rates. There was at some point also a very detailed forensic accounting exercise led by auditing giant KPMG.

According to Pervez, the audit cleared both brothers of any wrongdoing. But because their vindication was not made public and the accusations were the talk of the industry, they were shunned and made pariahs in the world that they once ruled.

“We were cleared. One hundred percent. But because there is now this impression that there was some corruption, we have been ostracised completely,” says Pervez Shahid.

When asked about the downfall, Tahir was not forthcoming. He waxes and wanes philosophical about the nature of business, but it is also the question at which he begins to reveal some of the bitterness.

“I brought these huge investments to Pakistan. But in my entire time at the group, my biggest enemies were Pakistanis. Not specific Pakistanis, but this nation in general. They are their own worst enemies,” he says.

Much of his dislike for his countrymen is a typical drawing room diatribe. Blame the people themselves when you cannot see systemic and endemic problems plaguing a nation. But it also comes from a place of hurt, because Bashir Tahir does feel wronged, this much is clear, even though he does not say it in so many words.

“Tell me, if you were the Sheikh, and I went up to you as a Pakistani and started cursing you in front of him? What would you make of it? You would think badly of me and wonder why my fellow countryman was saying such things about me.”

“And I’m not talking about regular people, there are big important people with important jobs saying these things. Jobs that give their words weight, and which automatically means I am being sold short or misrepresented,” he added.

Bashir Tahir does name names, but only off the record. Men who are now in exile or wanted or in jail who have held high offices in the land. But he remains resentful towards them. He feels cheated and betrayed, that people he helped went on to blame him in front of the Sheikh and effectively brought his career to an end. The worst part in his view, of course, is that the Sheikh believed them. And that seems to be a common theme, the Sheikh believing whatever he is told and making rash decisions regarding management that do more harm than good, even as he refuses to inject necessary capital as he did with Wateen.

By the time he was being made to leave the group, Bashir Tahir was in an interesting position. At this point, there were rumours that Bank Alfalah was up for grabs and the group was looking for buyers. The new management coming in feared that there could be a run on the bank. As the recently former, and possibly disgruntled, group CEO, he could have played sides, leaked information, or advised a rival group.

“When the entire overhaul took place, many people wanted me to take part in pressers and call out the Sheikh and Bank. Sheikh Nahayan called me then, and said that Bashir, I hope you won’t say anything about the group.”

To this I replied, your highness I will say things about the group and they will all be good,” he claims to have said on the final phone call. The Sheikh then told him he would want him to be his advisor, to which Tahir responded by saying it would be his honour.

“I still have that advisorship to this day but that’s pretty much it,” he laughs. One might consider it a retainer to keep his mouth shut.

This is where he begins to reveal just a little bit about some of the resentment he may hold towards the Sheikh. When asked, Bashir Tahir claims that Sheikh Nahayan has strong business acumen and comes by his reputation fairly. But the sense we get is that the Sheikh is easily hoodwinked. That he puts too much stock in rumours and what outsiders tell him about his own people. Something that has added to his regular changes in management. It is a widely held opinion, and seems also to be what Adeel Bajwa’s side holds true.

“Mr Bajwa has great regard for the Sheikh, everyone does. He is an impressive man, humble despite his pedigree and sharp as a tack. He knows business, he really does” our source on the Adeel Bajwa side of the fence tells us.

“But at the end of the day, he is a Sheikh. As modern a Sheikh as he may be, he is an executive of executives. And the problem with him in particular is that he easily believes everything that people tell him. And when it is high ranking people that are telling him these things, of course he will listen to them,” they say.

“But there is more to it than what they’re telling you,” he explains, for the first time hinting at the animosity between himself and the brothers. “There was a lot that KPMG found out actually, and the Sheikh just decided to let it go because of his relationship with the brothers.”

The claim is an extraordinary one. It essentially means Bashir Tahir could have been looking at another jail term if some fondness for an old friend had not softened the Sheikh’s heart towards him.

There were many other things, of course. The brothers had overly aggressive tactics, they could not sustain the losses anymore, and they were venturing into banking so much that the telecom side was being ignored. Indeed, Warid and Wateen were already staring down the barrel by this point, with their deal with the Defense Housing Authority (DHA) to provide internet to their residents falling through. But the most important thing Adeel Bajwa indicated is that the Sheikh might have dirt on the brothers, which is perhaps why they have gone down so amicably.

For all intents and purposes, this was the end of the brothers. For Adeel Bajwa, now was the time to shine more than ever and he grabbed the opportunity with both hands until he rose to the very top.

The aftermath of the brothers

If this were a thriller or a television show, the exit of the brothers would probably be followed by Adeel Bajwa being rushed in to replace the very men that hired him in the first place. It is a classic trope, but one that took a little longer to come full circle in real life.

The truth is that Adeel Bajwa barely made it out of that first management shuffle alive. It was entirely likely that he would go down with the brothers, having been appointed by them, and as many others did. But to put it simply, he proved to be indispensable. He knew far too much about the telecom side of the business, especially Warid and Wateen.

The group was in a mood to wrap things up with Wateen and Warid, with all the costs it was incurring. Adeel Bajwa was the only one that understood Wateen’s debt and all the complications surrounding its many licenses. So for now, he stayed on as the group’s General Counsel.

The replacement for the all-powerful Bashir Tahir was not a single person, but the safest of all possibilities: a four-person executive board. European through and through, the board began to be known as the ‘gora group’ within Dhabi circles.

The so-called ‘gora group’ is the Sheikh’s first anti-Pakistan reaction. Perhaps miffed by the intrigue and whispers surrounding Pakistani management, he went into this completely different direction, and the board reflected his leanings.

They were planning to wipe everything out. Consultants were hired and plans were made final to withdraw from Pakistan, and Adeel Bajwa was shipped off elsewhere. Indeed, the rumours were so strong that in January 2011, Dawn ran a story headlined “Abu Dhabi Group seeks exit from Pakistan market”.

As the group packed its bags, Adeel Bajwa was jetted off to Africa once again to put out some of the third world fires in that part of the world. This time, it was in an effort to trim down operations, with ‘reduce’ being the new motto for the group.

The Abu Dhabi Group had sought licences for banks in the region under Bashir Tahir. All of those plans were now cancelled. The telecom businesses that had almost got Bajwa killed back in the day were reformed, turned into lean operations, and sold off for profits to companies in Singapore. All in all, Bajwa was able to steer them out of most of the African assets with their money intact. And that is when he went back to Pakistan.

During this period Adeel Bajwa had become the man for mergers and acquisitions. The biggest thorn in the Sheikh’s backside in these days was Wateen, which had become next to unoperational thanks to rising costs, and Warid which was bleeding money by the day. Adeel Bajwa was chosen as the person who would sell off these poorly performing assets.

But it was here that Adeel Bajwa played his master stroke. It was 2014 and Warid had been the only telecom provider in Pakistan not to secure even a 3G license during the government’s 3G and 4G spectrum auctions. It was once again the same old story, the same old thorn in the Sheikh’s behind. Warid needed to be showered with money, and the Sheikh simply turned his head once again.

Adeel Bajwa then did the kind of managing that the Sheikh approved off, he was wiley, and with his years in the field, Bajwa not only managed to execute a highly favourable sale of Warid, he did so by also securing a 4G licence for next to no cost.

With the shift from 2G to 4G LTE, Warid became a desirable entity again. And when it was learned that it was up for grabs, Jazz swooped in and hands were shaken. In the all-shares transaction, Warid got a 15% share in Jazz, and Sheikh Nahayan got to keep a seat on the board. But in 2016, soon after the merger, Adeel Bajwa got a call to meet the Sheikh immediately.

There are many ways the story is told, but the one detail that is common is the gun room. In his palace in the UAE, the Sheikh receives guests in the ‘gun room.’ As the name suggests, the room has antique guns displayed all over the walls. An imposing sight, when Adeel Bajwa walked in surrounded by these ancient firearms, he was half expecting to be fire instead. What he got instead was a job offer.

There had not been anything particularly wrong with the board, but it had, according to Bajwa, become too conservative in its approach for the Sheikh’s liking, who had become used to the big swings of Bashir Tahir. So the board went.

He was also happy and impressed with Bajwa’s work, especially the frugal way in which he had managed to make Warid an attractive prospect and sell it at a good price. This in addition to the close working relationship they had developed since the departure of the brothers, an offer was extended to Adeel Bajwa to become the Abu Dhabi Group’s new CEO to replace Bashir Tahir.

He accepted immediately.

The lawyer becomes a banker

Bajwa had little time to bask in his new position. There were important matters to deal with, front and center being Bank Alfalah. The Sheikh was looking to get his hands clean from this as well. During the ‘Gora Group’s tenure, the group had already sold most of its shares in UBL, keeping a paltry 5%. The Sheikh also had to step down as the Chairman of UBL, a position he had held for 11 years.

Adeel Bajwa turned this around, insisting he would keep Bank Alfalah under the group’s umbrella. But what happened in the process was Bajwa finding himself a little out of depth, and paving the way to his own downfall.

His immediate strategy was stinginess. His first move was to announce to the higher management of Bank Alfalah that they were spending too much money, and he was there to put his foot down. The result was a back and forth with Atif Bajwa, unrelated to him and the man who had replaced Pervez Shahid as the group’s man responsible for Bank Alfalah.

A senior banker with a wealth of experience, Atif felt slighted at this lawyer from Abu Dhabi coming in and trying to tell him how to run a bank. The Sheikh, however, favoured this kind of behaviour, especially since much like Adeel Bajwa, he was more interested in immediate profits than in growth. Profit has been told on good authority that when Atif Bajwa would go to give presentations to the Sheikh in the UAE, Adeel would sit in and nit pick on his points. Once again, his banker’s pride was slighted.

As CEO of Bank Alfalah, Atif Bajwa felt Adeel was being heavy-handed and not letting him run the bank to his full capabilities. As the tensions simmered and came to a boil between the two Bajwas, Atif made an ultimatum to the Sheikh. The Sheikh sided with his (then) trusty lawyer, leaving the field open for Adeel to bring in his own man to run the bank.

The headhunt for a new CEO for Bank Alfalah led Adeel Bajwa to Nouman Ansari, who he poached from Faysal Bank and installed as Alfalah’s new CEO. Ansari’s appointment also pointed towards another ambition of Bajwa’s, that quite contrary to the Sheikh’s initial desires to dump Alfalah, he wanted to expand it. And part of his expansion plan was to acquire Faysal Bank.

Ansari in turn proved even more frugal than Bajwa, embarking on the cost cutting measures with a certain zeal that justified his appointment, at least to Adeel Bajwa’s mind. At the same time, he wanted to make sure that the Abu Dhabi Group’s many real estate projects in Punjab, including Taavun and the plaza on Lahore’s Ferozpur Road initiated by the brothers be completed.

His ambition, however, continued to be beaten into submission by Bank Alfalah, which continued to slip. Where it had once had ambitions to enter the top four of Pakistani banks, it also lost its formerly constant spot at number 5, slipping down to 7. On March 20, 2019, Adeel Bajwa announced he was resigning from the Abu Dhabi Group to pursue an ‘exciting new assignment’.

The exit was as shrouded in mystery as that of the brothers. The group has not alleged any wrongdoing on Bajwa’s part, but it once again seems they are holding back. In turn, so is Bajwa, not really saying anything explicit against the Sheikh or the group.

What we do know, however, is that the exit did not have anything to do with Bank Alfalah, despite the slipping rankings. Up until now, Bajwa had been claiming he left of his own volition. Now, he says he does not know why he has been removed. But at the core of it was alleged corruption.

At some point, Bajwa wished to rid the group’s hands of the very thing he was hired for: Wateen. To this end, he started making moves to sell Wateen to an American firm. Once again, this is where details and reality begin to blur. But it has been reported that Bajwa made all the arrangements, and went off to Abu Dhabi to get approval from the Sheikh. The Sheikh, once again hounded by rumours and whispers, apparently grew suspicious and started asking around after the firm. This was enough to convince the Sheikh that the firm was fake, and would somehow lead back to Adeel Bajwa, who stood to make a killing of Wateen.

That, at least, is the version that the Sheikh believes for all intents and purposes. The details are a little different. The company that Wateen was being sold to, and Wateen really needs to be sold, was called Elko broadband. They are currently buying WorldCall since the deal with Wateen fell through, which would indicate they were a legitimate buyer.

The Sheikh’s paranoia has lost Wateen a buyer, and who knows when another one will show up, and whether Wateen will even manage to stay afloat in the meantime. What is worse is that the group has not even made any allegations against Adeel Bajwa public, probably to save face themselves. Profit has learned on good authority that the group had to pay off a certain publication to stop printing stories detailing the allegations against Wateen and Adeel Bajwa, to try and stop the information from leaking into the public.

At the same time, the assignment Bajwa claimed to be leaving for has still not arrived, unless he was talking about the multiple criminal and civil cases he is embroiled in with the brothers over the scraps of land that the Sheikh left to his Pakistani CEOs as bonuses.

Since his ‘resignation,’ Dominique Liana Russo has been running the show. She further discovered that the person on the front of the firm Wateen was being sold to was an ex-convict. In the meantime, Elko broadband is deliberating suing her, since she was the one that finalised the cancellation of the Wateen sale after replacing Adeel Bajwa. But how long she will enjoy the Sheikh’s trust is yet to be seen. But precedent does not seem to favour her having a clean break. The Sheikh seems to be of the bulldozing disposition.

What now?

Dominique Liana Russo met with Punjab Chief Minister Usman Buzdar a few months ago in late April to discuss the Abu Dhabi Group’s projects in the Punjab. The CM’s message was clear: a lot of investment opportunities are available in Punjab, he said, and ‘naya’ Pakistan is open to investors.

He said all the right things. That the government would provide every possible facility to the investors, that the Abu Dhabi Group already has extensive investments in Pakistan, that a comprehensive policy has been adopted to promote public-private partnership etc.

It is a different time for sure. A different CEO and a different Chief Minister. And for some reason, we have a feeling that, despite his towering stature, intellect, and natural charm, Chief Minister Buzdar is not going to form a close relationship with Ms Russo as Bashir Tahir did with Pervez Elahi.

A whole lot of things are different. What remains the same is Pakistan’s interest in keeping the Abu Dhabi Group and its money in the country. What might be another difference, however, is the Abu Dhabi Group’s interest in staying around in the country. And the Sheikh might just be in even more of a hurry to leave because of the actions of his two former CEOs, both of whom are involved in a mudslinging match for the ages. But what they are fighting over is a creation of none other than the Sheikh.

In 2019, when Adeel Bajwa left the group, he came back to Pakistan with much to show for. But one of the biggest assets he brought with him was the ownership of a large commercial plot near main MM Alam Road in Lahore – prime real estate. The plot was given to him by the Sheikh in lieu of his annual bonus. And that’s where the brothers come back into the story.

As part of his time at the Abu Dhabi Group, Bashir Tahir had invested some of his own money in some of the group’s investments. One was a tower site maintenance company called Wincom (Pvt.) Ltd that would provide services to Wateen. About 80% of it was owned by Sheikh Nahayan, and 10% each by the two brothers. Setting up their own company was Pervez Shahid’s idea since Huawei and other such providers were charging very high rates.

It did quite well over the years and had assets of over Rs2.5 billion by 2011-12, when the separation took place. By then it was providing services mainly to Warid and Wateen, and to some other external customers as well. Pervez Shahid says it was set up with an equity capital of Rs50,000, which he paid. Since 2011 however, the brothers have not seen any of the money from their shares in the company.

Part of those Rs2.5 billion in assets was the plot that the Sheikh now gave to Adeel Bajwa. True enough, Sheikh Nahayan owned 80% of the company and could do with it as he liked, but in the process, the brothers’ minority share was turned to dust.

When Adeel Bajwa returned to Pakistan, the brothers contacted him to settle the matter. He stood his ground; the property is mine he said. The brothers filed a civil suit, as Bajwa had expected. What he did not expect was the criminal case against him that would follow. The charge? Land grabbing.

The brothers are not named in the criminal FIR. But Adeel Bajwa’s friends and benefactors insist that they are naturally the ones behind it.

The interesting part is the response of the Sheikh: complete silence. Apparently, Adeel Bajwa waves the documents signed by the Sheikh on his own stationary to any and everyone he meets. Documents that prove his ownership of the land, but the Sheikh has become a party to the civil suit instead. The question is: if the Sheikh did not give Adeel Bajwa the property, where do the documents come from?

One of the possibilities is that the Sheikh did indeed give Adeel Bajwa this property, but after his alleged attempt to dupe him out of Wateen, he does not want him to keep it. But if that was the case, does the Sheikh just plan on strong arming Bajwa without the aid of the law? Even then, if he does do that, how does he plan on compensating the brothers, who were shareholders in the property?

All of Profit’s attempts to reach out to the Sheikh, to Ms Russo and to the Group went unanswered. No answers were received on the issue of the squabble between the brothers and Adeel Bajwa. Nor did we get a response on whether the group was planning on leaving Pakistan, or whether Bank Alfalah was up for sale again, or why the Sheikh had such a problem maintaining management regimes for the group. The closest we got to a response were the friendly and not so friendly requests to kill this story.

The group’s silence is ominous. For now, they have too much in Pakistan to straight up pack their bags and leave. The only thing truly worth keeping is Bank Alfalah, and even that is slipping. But this would not be the first time that the Sheikh has wanted to exit Pakistan. The last time he did, he also removed his Pakistani executive and had a group of Europeans try and make the plan work. It seems a similar story this time. And with Pakistan at a troubled juncture, it might just happen this time, leaving behind nothing but two discarded grand viziers fighting over the carcass of the empire. Over one final gift from the magnanimous, the mysterious, the enigmatic Sheikh.

I still remember when I was working for Warid Telecom – it was known as fnf ‘friends and family’ due the BT and PS. Lots of scams especially practically activating Sims for BAL customers without their knowledge, cronyism, pushing employees to invest in Wateen shares and Bank AlFalah Housing Society (another scam). It’s good to know that BT/PS and their extended families are living a life of luxury because they earned the ill will of thousands of employees of Warid, Wateen, BAL and related businesses. The day I resigned from Warid Telecom was the happiest day of my life.

Sounds like a disgruntled employee who was asked to leave Warid due to poor performance.

Those who are single-handedly responsible for bringing in billions of dollars worth of foreign investment into the country and creating tens of thousands of white collar jobs can never be the recipients of ill-will from those same employees who found jobs in the companies that they set up. It is only thankless or incompetent people like you who could think is such a despicable manner. Shame on you.

Well, it turns out hat the ones you are protecting were bundled out of their offices without even being given time to collect their belongings.

How about you clarify Bank AlFalah Housing Society scam, the way employees were asked to purchase Wateen shares and how the franchisees were cursing the management?

It is true, that now the position is (the end of Abu Dhabi Group) due to Dirty/thief Pakistani Management who waisted and destroyed Sheikh Nahyan Al Mubarak’s Wealth for their own interests,

You sound like an RSS member like Narendra Modi, bashing Pakistan and Pakistanis for no reason. Shame on you.

Shame on you for spreading fake news just like your father. Karma’s a bitch. You shameless piece of shit. The media in this country is the biggest source Of terrorIsm and blackmailing.

Well I have been working with HH Sh Nahyan بن Mabark Alnahyan on all these stories and on instructions of HH I worked with KPMG UK No one in Pakistan Knew better than me I know all the Groups in Pakistan who fleece Sh Nahyan بن Mabark Alnahyan billions of Dollars, When any one Contact me I will disclose I have many meetings in this regard with Sh Nahyan very sad story for Pakistan as well

The fact is that the Sheikh is not innocent. As described by Adeel Bajwa in this article, Nahayan is a sharp businessman and an executive of executives. He knew exactly what he was doing, where his money was being invested, and why. His greed for windfall telecom sector profits based on the widely acclaimed and successful Warid-Singtel transaction led him to literally order his management to go and seek out telecom licences all across Africa and South Asia. Over-leveraging (in terms of excessive debt) and a genuine dearth of equity capital is what led to his downfall, not Pakistani management. Let’s call a spade a spade and not beat around the bush.

“we have a feeling that, despite his towering stature, intellect, and natural charm, Chief Minister Buzdar is not going to form a close relationship with Ms Russo as Bashir Tahir did with Pervez Elahi.”

That was mean Profit. The sarcasm was obvious 🙂

The biggest mistake Sheikh did was to trust Lahoris one after another. They are masters of deception and shady tactics. Lack of unprofessionalism runs in them. It may sound as racist but that’s the truth for a large majority. All employees of Warid and Wateen knew the kind of leadership they had.

Ahem Abraaj ? BCCI ??

Buddy – you stay put in Karachi

The biggest bank defaults in Pakistan have taken place in Karachi. To blame Lahoris nothing but racism and hurling of false accusations. Do remember that the same Lahoris you are referring to are responsible for attracting billions of dollars in FDI into Pakistan. So have some shame. And keep your racism to yourself, lest you start sounding like the RSS.

Can you name those biggest defaults that have taken place in Karachi? Yeah right, Azgard 9, Lake City/Ejaz Group, Chenab group, Dewan Group, Colony group, Crescent Group and the list is long. I belong to banking sector and NPL rate is ALWAYS higher in Lahore and Faisalabad as compared to Karachi, whether its a big group or we are talking about credit card defaults. Better to refer to some data before claiming something.

It would be great if you publish case studies with such content for universities. We barely have local case studies for business schools and students are being taught Harvard amd Insead case studies at IBA and LUMS. This will help you generate revenue per case study per student and also provide students with an understanding of local industry and companies. This is such a good case with strong characters. Successful companies and lots of analysis.

Case studies for how to evade corporate governance. The story does not talk about the shady deal between wateen and national engineers

Excellent article…same opinion was given by almost everyone I shared this piece of writing with. Look forward to reading more such pieces from Profit Magazine in future..Just one addition to the story which the writer may know of but didn’t put in this article intentionally – that one major and final reason for Bashir Tahir & Parvez Shahid ouster was the marriage breakup between Parvez Shahid’s son and Chaudhry Munir’s daughter and since Ch. Munir was very very close to the Sheikh, he made sure that he teaches his daughter’s ex-inlaws a lesson…

Wow, great article.

nice work, thanks for the informative article.

Good Job

[…] may may noted that the group’s financial and managerial woes have only increased in the decade or so. From 2011-2016, the group was run by a four-person team of […]

How much fine