The GAP, Ralph Lauren, Hugo Boss, Zara, Armani, Nike – what do they have in common? All of them are luxury fashion retail brands spread all over the world. All of the brands originate from Europe or North America. All of them are globally in demand. All of them produce their clothes in the global south.

While these fashion brands were once coveted because of their mystique and exclusivity, they eventually found that the global demand for their clothes meant they would have to pivot towards becoming mass producing fashion retailers. To make this system profitable, however, it was necessary to find places where their clothes could be manufactured cheaply without compromising on quality.

Over the years, Pakistan, India, and Bangladesh’s textile industries have filled this role, getting massive orders from these brands. With cheap labour, raw materials, and very little regard for working conditions the Indian subcontinent fit the bill perfectly. One of the industries that this spawns, however, is export leftovers.

Large brands have very specific criterias for the clothes they want to sell, which means even if there are small inconsistencies or imperceptible flaws in the clothes like a wonky stitch or a mismatched button, they get rejected from being exported to western countries. This leaves the countries producing with a problem – suddenly they have tens of thousands of branded shirts or pants or pairs of underwear or socks in stock and their clients are not willing to take them. Since the defects in these pieces are miniscule, the products end up being sold for cheap in the country they are being produced in.

Traditionally in Pakistan, the factory owners set up retail business on the side for these leftovers or sell them directly to their preferred retailers at high prices. However, a recent trend in Pakistan has been the influx of export leftovers coming into the country from Bangladesh – both through legal imports and through smuggling routes. With the rise of social media marketing, people can (and have) set up businesses from their home, operating through Facebook, Whatsapp and Instagram selling these products from Bangladesh. And they are giving the local fashion retail industry a run for their money.

The fashion industry and its leftovers

In Pakistan, the business of export leftovers has been common for a while. Garment factories end up over producing due to inefficiencies or because some of their products have minor flaws in them. However, because the owners of the factories either sell the clothes themselves or have partnerships with retailers, the prices of these clothes are high.

With 3000 garment factories in the country, according to one estimate, Pakistan ends up with as many as 5 million pieces that are then sold in the fashion retail market. But because of the high prices, it is actually cheaper to buy shirts made in Bangladesh which are also supposed to be of a higher quality. It is a strange situation in terms of economic theory – Pakistani made products are local and more readily available, but they are more expensive while the relatively unavailable Bangladeshi products are cheaper even though they have to be imported. If a Ralph Lauren shirt made in Pakistan costs between Rs 4500 – 6500, the same shirt brought in from Bangladesh will be as cheap as Rs 2000.

This is largely because of the insistence of the local industry to price their products higher. They are not producing 5 million products a year because of demand, but because they have production inefficiencies that leave them with extras. At the same time, they sell these extra products in small quantities to retailers which means the rates are higher – in Bangladesh they are sold in bulk quantities known as ‘lots.’

It makes sense because Bangladesh is producing more and better products than Pakistan. In their 50 year history, the nation has banked on its textiles and has developed them into a complete process from raw materials to finished products. With its cheap labour and electricity, the garment industry of Bangladesh has been the key export division and a main source of foreign exchange for the last 25 years. In the last seven years, Bangladesh’s garment industry has increased its annual revenue from $19 billion to $34 billion—a 79 percent rise. This makes the country the second largest exporter of garments in the world, with the sector accounting for 80 percent of Bangladesh’s total export earnings.

The industry provides employment to about 3 million workers of whom 90% are women. They are the 2nd largest individual country for apparel manufacturing in the world behind China and are where brands like H&M, Target and Marks and Spencer produce much of their goods. Currently, the textile industry accounts for 45% of all industrial employment in the country and contributes 5% of the total national income. Within this, the Ready-Made-Garments (RMG) industry is the fastest growing. By 2014 the RMG industry represented 81.13 percent of Bangladesh’s total export. As of 2019, there were nearly 5000 garment factories in Bangladesh compared to Pakistan’s 3000.

The export leftovers industry that these RMG manufacturers spawn is massive. Now, when we talk about brand names like Ralph Lauren or The GAP, it is a very particular segment of the Pakistani apparel retail market. Pakistan’s apparel retail industry has flourished in recent years. The Pakistani apparel retail industry had total revenues of $9.1 billion in 2018, representing a compound annual growth rate (CAGR) of 5.9% between 2014 and 2018. The menswear segment was the industry’s most lucrative in 2018, with total revenues of $4.6 billion, equivalent to 50.4% of the industry’s overall value. Most of this comes from local fashion retailers that produce traditional eastern wear – giants like Sapphire and Gul Ahmed. However, there are two very interesting facts that might be giving rise to the influx in Bangladeshi leftover clothing.

The first is that growth within the Pakistani industry has been encouraged by economic prosperity in urban areas. Urbanization has led to improved living standards, higher disposable income and improved retail spaces, which supported increased spending. The entry of women into the workforce has meant they also have disposable income and it has given a massive push to the retail fashion industry locally. Then there is the more important fact, which is that in the fashion segment, 18% of total market revenue will be generated through online sales by 2023. This is where the future of competition lies.

Everything is online

Omar Butt wakes up everyday and the first thing he checks is his social media. On Facebook, Instagram and Whatsapp he has hundreds of messages from different people asking him to sell them clothes. He then gets up, responds to the messages, and heads off to the warehouses he has in the city. The ‘warehouses’ as he refers to them are two small rented residential houses in Wapda Town that are filled top to bottom with clothes imported from Bangladesh. Whether they get there legally or not, Butt does not know. He gets them from a middle-man. All he knows is that he gets them cheap and markets them well on social media, and manages to make a pretty penny out of it.

“In 2013, I had no job or business to do. During this time, a friend of mine who used to visit Dubai suggested that I start a branded clothing business. My first question was where I would buy these clothes from, and secondly who would buy such expensive clothes? My friend reassured me that I should leave it at that. Since I did not have a shop, my friend’s advice was that I should not do this work in the open market but in closed groups. So I set aside my home drawing room for this business,” he explains.

According to Butt, he thought that maybe his friend who goes to Dubai regularly would buy the branded clothes from there and Butt would sell the goods to different people but this did not happen. Instead, the friend introduced him to a man from Lahore who was already working on branded clothes. Butt was taken to this man’s warehouse which was a rented house in Lahore’s residential Johar Town area. From the get-go it seemed shady to Butt. However, he had done his research and knew how to recognise whether the shirts were original.

When Butt got to the place, the house was filled to the brim with clothes from at least 30 different international brands. Stocked with different sizes and colours, all of the shirts still had their tags. When he scanned the QR codes on the tags, they took them straight to the websites of these brands. Butt knew the clothes were for real, but what surprised him more were the prices that were being offered. “I was quite surprised when the man I was meeting said that the wholesale rate of casual shirts was Rs 950,” he explains.

“I immediately thought that I could easily sell this shirt for Rs 2000. There were also shirts from brands such as Prada, Polo, Armani, Burton, Marks & Spencer, Zaraman and H&M. Now when I reviewed the pants, there were paints from Diesel, Levi’s, True Religion, H&M and other luxury brands that are usually very expensive. These pants also had price tags ranging from $150 to $250, however, the wholesale price of the pants was stated by the said person as Rs 1,000 to Rs 1,200,” he said.

From this point on there really was no looking back. Butt immediately ordered pants, trousers, and belts and both formal and casual shirts from various brands in bulk. The man promised him that the shipment would arrive soon and soon he received his order. With no store, Butt simply uploaded well taken pictures of the clothes to a Facebook page and gave people his address so that they could come check out his stock themselves and ascertain that all the clothes were original and not knock off pieces. The man Butt got the stock from was a simple importer and did not know much about selling products. Butt was savy in this department and in this way used his marketing skills to sell the products.

“All these clothes were made in Bangladesh and they had the ‘Made in Bangladesh’ tag on them. I bought the entire stock for around Rs 400,000 and I set all these things in my drawing room. People saw my posts on Facebook and contacted me. I was selling shirts you couldn’t find anywhere for less than Rs 6000 for around Rs 2000 because I had gotten the whole bulk order so cheap. At this point, I also saw a pattern and noticed people that were regular customers,” he explains. “For them I created Whatsapp groups where I would show them my stock before I displayed it publicly and they would buy a lot of the good stuff directly before anyone knew about it at a premium price. This worked well for everyone involved. Right now I’m running a Facebook page and 22 WhatsApp groups.”

“I started this business at the end of 2013. At that time the value of the dollar was not very high and the profit margin was so great that I used to sell goods that I got for Rs 400,000 for Rs 900,000. Now, I have rented two houses in Wapda Town, Lahore where all these clothes are sold. I also have a variety of Bangladeshi made clothes for women and children which are sold hand in hand.”

How does it come to this – smuggled or legal?

Butt still has no idea how these clothes get to him. All he knows is that he still goes to the middle man who sells him his stock in bulk and he comes back, stores it, markets it, and sells it. The problem is that while most clothes from Bangladesh are imported, a lot are also smuggled into the country. Most of the smuggling happens when people visiting Bangladesh bring back clothes pretending they bought them for personal use when in fact they bring them here to sell.

Butt claimed that Excise and Customs Department staff visited his business point several times over a seven-year period but never sealed his business because he managed them well. “Because I run a branded clothing and accessories business, my clients are high government officials, lawyers, judges, bureaucrats and army officers. They help me whenever I have a problem,” he claimed.

When Butt was asked if his business was now large enough to buy directly from Bangladesh without a middleman, he replied that it was not. “I am still buying from the person from whom I started buying garments and accessories on the first day. However I am always on the lookout now. If I ever go to Dubai or any European country, I will definitely bring different things for my customers from there. Because in foreign countries, most of the valuables are sold cheaply when they are on sale and when they are brought here and sold, we get good profit. Just before the pandemic, I brought perfumes, shirts and tracksuits from Dubai that were a bit more expensive, but those who wear the brands are alright with buying more pricey items every now and then.”

While Butt admitted all of this quite freely, he claimed to have no knowledge of how the clothes got to Pakistan. For this, Profit also visited various markets and reached out to the cloth people involved in the business as well as smugglers. The story of how these clothes from Bangladesh reach customers is fascinating, and what is more interesting is that authorities are deliberately keeping quiet about it.

This is how they get here

“It all starts in Karachi. Bangladeshi textile companies have orders to manufacture garments of European, American and British brands. Most of the textile mills in Pakistan also have orders for these brands. Now, when we talk about smuggling or availability of Bangladeshi clothes in Pakistan, the first question that arises is that if Bangladesh has made shirts for Armani, for example, how did they get to Pakistan?” says Seth Shaukat, a Karachi based businessman. He claims that not every Bangladeshi garment needs to be smuggled but to sell branded clothes one has to get permission from the respective brands. “This is where the sale of the rejected readymade garments begins. These garments go from Bangladesh to India and also to Pakistan. In this way, sometimes some traders from Karachi or Lahore go to Bangladesh and visit the textile industries there and book their order and bring it to Pakistan. These orders come by air as well as by ship. For this, the buyer also pays the customs duty and legally keeps the garments in his warehouse. Import of readymade garments in Pakistan is not an easy step but 20 percent customs duty has to be paid on its import. Similarly, sales tax is 17 percent, regulatory duty is 10 percent, income tax is 11 percent and additional customs duty is 6 percent,” he explains.

“Similarly, if we look at the total, the importer will pay a total tax of 64 percent on the amount of garments he imports. For example, if a shirt is bought from Bangladesh for RS 200, it will cost the importer RS 328 while paying its duties and taxes. I myself have been to Dhaka twice to buy Bangladesh ready-made garments and there you will find ready-made garments of every category. However, I must say that if a garment has been rejected because it is not A plus quality, that does not mean it is B quality. It is rather A quality or A minus quality instead of A plus. It is always very minor details or flaws.”

The Bangladeshi factories sell these leftovers in bulk. Most of the people hoping to sell in Pakistan do not want to sell just a single product. So if they are buying 500 pairs of pants, they will also place an order for 1000 shirts that their customers can get with those pants. This will then mean that they buy socks, undergarments and belts etc in the same amounts as well. There are some factors that are important here. Some textile mills are selling products that are in the original packaging and have QR codes on them that can prove they are original. These are more expensive than the textile mills that sell their leftover products openly without packaging or tags.

This is because within Bangladesh there is not a lot of demand for these products so manufacturers want to get their hands off the excess production. Some are savvy and tag and package the clothes to sell them at a premium price, but others just want to get rid of them.

“The rates available to me a few days ago in various designs and sizes of H&M are such that a shirt is costing 340 Taka in a Bangladeshi lot,” says Shaukat. “Now that the currency of Bangladesh has become expensive, you will get a shirt from Bangladesh for around Rs 667 and if 64 percent duty is added on it, then the price of this shirt will go above one thousand rupees,” Shaukat informed. These shirts are then sold for around 200 to 2500, which are still much lower than the prices Pakistani retailers are offering, and that too for shirts that are not as high quality as the ones from Bangladesh. In case the shirts are smuggled instead of imported legally, the margins are even more for the sellers. While the rupee devaluation in recent times has meant less profits for these importers, it has meant better things for the smugglers.

“Everything is on social media these days. There are dozens of Whatsapp groups where importers find out about what products are available in Bangladesh and what the prices of available lots are. Sometimes, the importer does not even have to go to Bangladesh. He books lots through bank guarantees and receives them in Pakistan. This is where the sale of Bangladeshi garments in Pakistan begins. Any shirt, or pair of pants or any ready-made garment, for example, which costs an importer Rs 1000 to import, he can sell it for between Rs 2,000 and Rs 4,000. Polo, for example, is an expensive brand and the shopkeeper or supplier who has to buy one of its lots has to sell the shirt to the customer for at least Rs 3000 to Rs 4000, and the customer has to be satisfied that this shirt is original because he or she will also see the same shirt on the official website of Polo through QR code,” he said.

The extent of the smuggling

However, Shaukat says that if 60 percent of Bangladeshi readymade garments are being imported into Pakistan, the remaining 40 per cent reach the local markets through smuggling. The claim is seconded by many traders that are candid about this fact. One trader in Lahore’s Azam Cloth Market famous for their involvement in textile smuggling has been caught several times by customs officials. The trader/smuggler wished to be unnamed and believed that smuggling of unstitched garments and ready-made garments in Pakistan was not a difficult task.

“In Lahore and Karachi, on a daily basis, containers of clothes and ready-made garments are smuggled through Peshawar. The containers also carry goods from China and Bangladesh. All this cloth comes from Peshawar through Afghanistan. If you consider, branded clothing stores have opened in cities like Abbottabad and Mansehra and they sell original branded readymade garments at very cheap prices. Many garment stores have opened on Karakoram Road, a short distance from Abbottabad, where clothes of Mango, Levi’s, and True Religion, Diesel, Nike, Gucci, Prada and other very expensive brands are readily available,” they say.

“Similarly, ready-made garments smuggled to Rawalpindi, Islamabad, Gujarat, Gujranwala, Lahore and Karachi are being sold easily. Warehouses of smuggled readymade garments are also present in the Northern Areas, Islamabad, Rawalpindi and Lahore and Karachi. From here, clothes are available at very cheap prices and customers also get cheap prices. I bought an H&M smuggled shirt for Rs 1200. Now think for yourself that the price of a brand like H&M is Rs 1200 and is the best quality shirt available anywhere in the world? These branded readymade garments are smuggled and imported here because the people here want to wear them,” he informed.

Yasir Sarfraz, a trader of Panorama, puts forward the story of the said smuggler in such a way that people demand brand, quality and low price and all this is very difficult in Made in Pakistan clothes. “Either a lot of brands do not make their clothes in Pakistan or the ones that do are not of a very high quality,” he says. “You could buy a pair of Levis jeans from a Levis store for Rs 6000, or you could get a pair of the same jeans, probably more professionally manufactured, for Rs 1800 from an importer. If you are able to find a pair of pants brought in by a smuggler, they will be as cheap as Rs 1200.”

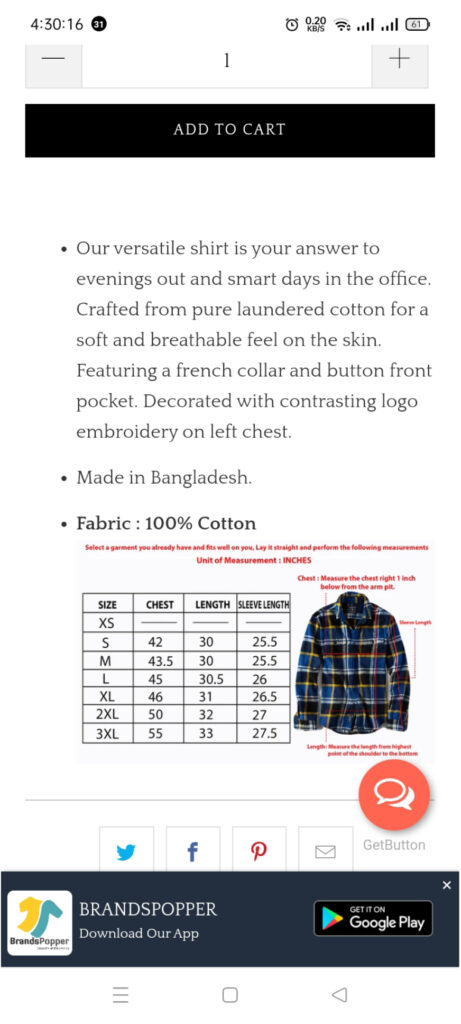

Because of such massive differentials in prices, the demand for Bangladeshi readymade garments, whether smuggled or imported, has skyrocketed. In Lahore’s Karim Block Market, a shop called Jobbers is openly selling Bangladeshi garments, while an e-commerce web portal is openly selling Bangladeshi clothes under the name Brandspopper.com. Not only that, but Bangladeshi readymade garments are being sold through many websites, Facebook pages and WhatsApp groups.

“This is obviously damaging the local textile industry, but they have no one to blame but themselves,” says Sarfara. “They do not seem capable of providing A quality products to their own people and instead produce B quality products and sell them at astronomical prices. Perhaps the only exception is www.exportleftovers.com, which is selling good quality readymade garments at low prices and that is why they are gaining popularity among those who are interested in branded clothes.”

“Our branded clothing enthusiasts also flocked to flea markets where used clothes from the United States, London and European countries come. Most of these clothes are in very good and new condition. I also have a shop in the flea bazaar in Anarkali, but ever since the Coronavirus, this used clothing container has also become so expensive that if one hundred shirts out of a thousand shirts come out in good condition, they will be sold in the flea market for between Rs 800 and Rs 1,200. As a result, people are now opting for Bangladeshi ready-made garments instead of turning to these flea markets. There are many shopkeepers in our market who buy and sell smuggled clothes and if ever the customs authorities ask them for an import receipt or documents about the sale and purchase of these garments, they do not have anything to prove that they are not selling smuggled garments,” he informed.

Customs maintains that smuggling from Bangladesh was not possible, and that many people at most bring some ready-made garments with them to Dubai or Bangladesh and they claim that they have bought these items for their personal use or as gifts to relatives, but they in fact intend to sell. In such cases, they cannot take any action. Despite these claims, it is abundantly clear that Bangladeshi clothes coming into Pakistan are not only increasing with time, but are biting off a significant chunk of the branded fashion retail market in Pakistan. Whether this will grow or whether the garment factories will finally step up is yet to be seen.

Sir me Sri Lanka k left over kids collection wholesale rate py perches kny k Liye buy krna chahti ho plz guide me

Can we import this leftover cloth in Pakistan.

I want to import this leftover please tell me detail