In Pakistan, gold is more than just a precious metal – it’s a cultural powerhouse. A symbol of honour and wealth that binds relationships together with its glittering allure. Imagine having a Desi wedding without the dazzling display of gold jewellery visible from miles away. Unthinkable! And if you dare to try, you’ll never hear the end of it.

But gold’s value extends far beyond its cultural significance. In times of economic turmoil, it becomes a beacon of hope – a store of value that shields many from the harsh impacts of a rapidly depreciating currency.

As inflation skyrockets to unprecedented heights and the rupee plummets to all-time lows, there’s only one other currency that’s acceptable besides the highly coveted dollar – gold.

Picture our economy as a sinking ship. Dollars are the lifeboats, but they’re in short supply. What’s the next best thing? Gold. It’s the closest thing to a lifejacket in these treacherous waters. That’s how Pakistanis see it as they scramble to amass as much gold as possible in a desperate bid to retain their purchasing power against the rapidly dwindling rupee.

Where does gold in Pakistan come from and has the supply been steady?

Despite its limited foreign reserves, Pakistan’s population exhibits a strong affinity for gold. This fervent desire for the precious metal, coupled with the country’s lack of domestic gold reserves, necessitates a reliance on imports to meet the demand.

Investment-grade gold typically consists of 24-carat gold, the purest form of the metal. The most desirable sources of investment gold are found primarily in the Americas and the Middle East. It is customary for Pakistanis visiting Saudi Arabia on pilgrimage to purchase gold and bring it back for their relatives. Similarly, individuals returning from the United States are often asked to bring back jewellery as a favour.

The New York Times reported on Pakistan’s gold trade, describing its coastline along the Arabian Sea as a popular destination for gold smugglers. In October 1993, during Benazir Bhutto’s second term as Prime Minister, Dubai-based bullion trader Abdul Razzak Yaqub (ARY) proposed that the government regulate the trade by issuing him an import licence. That licence was eventually granted under some very controversial circumstances. Profit did a detailed story on ARY’s beginnings in the gold to the media conglomerate it is today.

Despite this proposal, Pakistan’s gold trade remains largely unregulated to this day. As a result, buyers remain sceptical about the quality and authenticity of the gold they purchase.

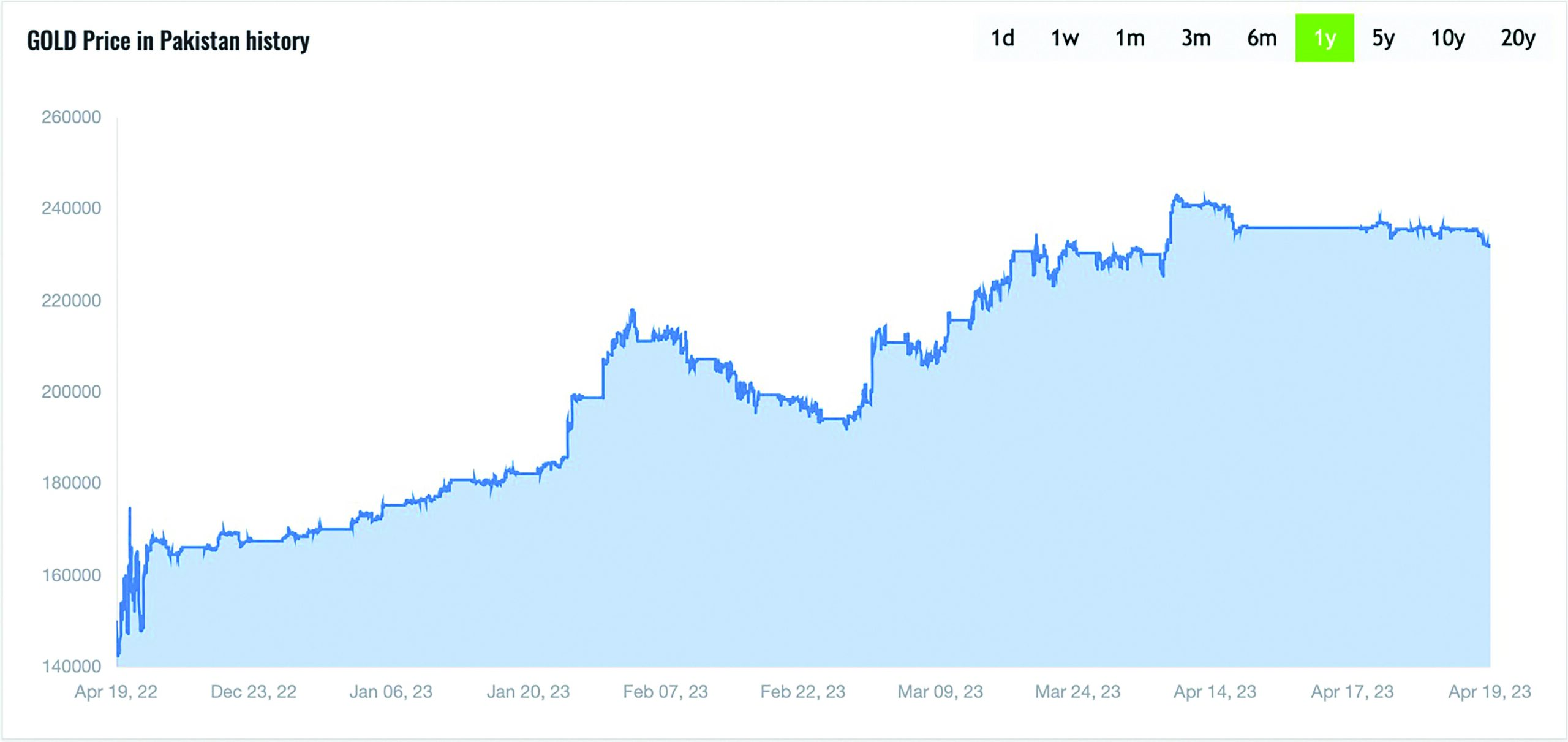

Sarmaaya records the fluctuations in gold prices per tola.. Within the span of one week, the price of one tola of gold has gone from Rs 242,898 to Rs 231,939, as shown in the graph below. This shows that gold is a highly volatile asset.

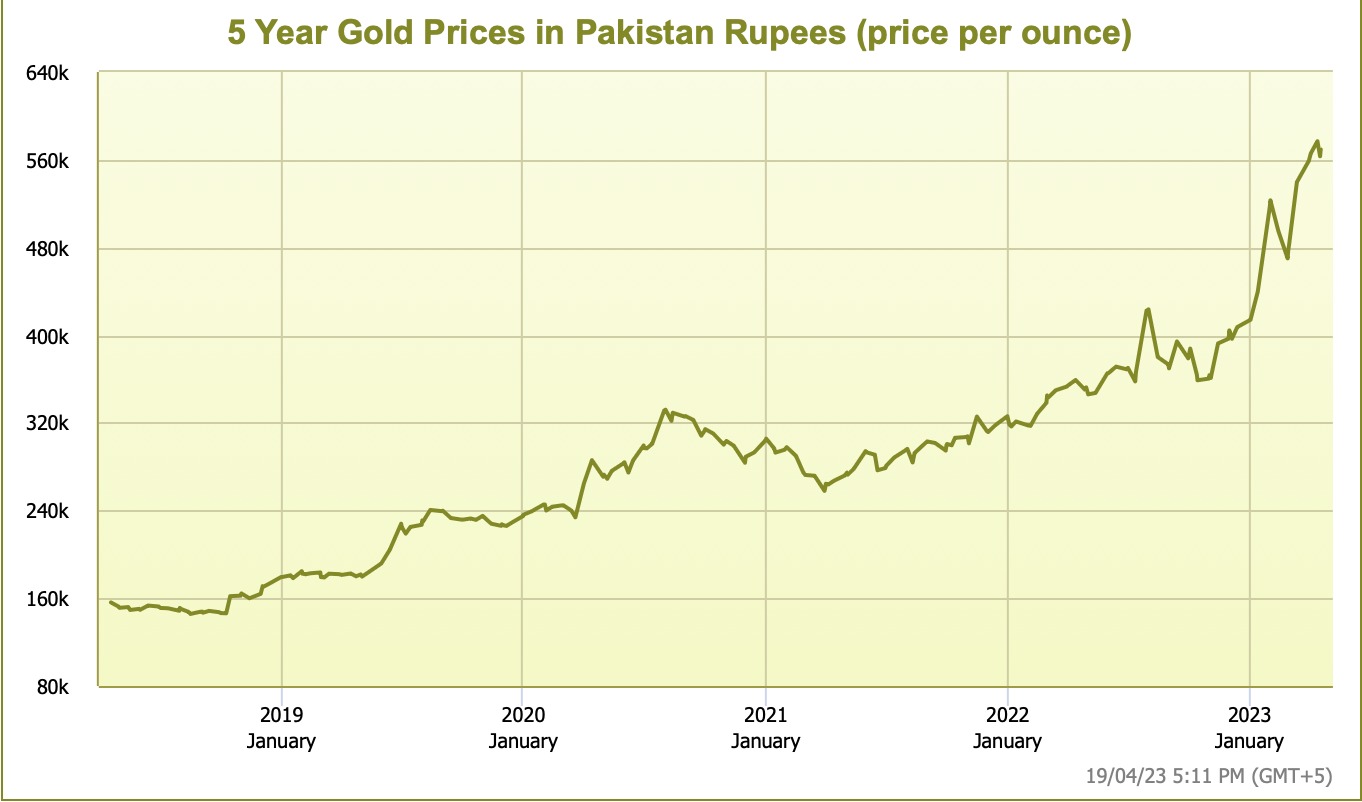

Moreover, gold prices have consistently risen in the past five years. The price of gold per ounce was Rs 156,219 in April, 2018, soaring to Rs 569,386 in April 2023.

Moreover, gold prices have consistently risen in the past five years. The price of gold per ounce was Rs 156,219 in April, 2018, soaring to Rs 569,386 in April 2023.

Dollarisation and its sequel for gold

Dollarisation and its sequel for gold

Profit will guide you on an exploration of how gold may emerge as the second most valuable or simply an acceptable currency if the country exhausts its dollar reserves.

Amidst hyperinflation in Pakistan, retaining the rupee’s value has precipitated a daily erosion of purchasing power for people’s wealth, provoking grave concern. In stable times, the focus is on achieving superior returns. However, during inflationary periods, concerns transcend returns and become a matter of survival. Pakistanis are habituated to an annual inflation rate of 8-10%. Panic remains contained as long as the rate stays within these bearable figures. However, when it exceeds these figures – in the current case, at a historical high of 35.4% no less- panic ensues.

So what is going on?

Nasim Beg, Director at Arif Habib Corporation, elucidated the current crisis for Profit’s readers by outlining the trajectory that Pakistan has followed over the past 50 years, which has now brought it to the precipice of a possible default. “The situation is straightforward; Pakistan has inadequate foreign exchange earnings, rendering us incapable of purchasing the items we are accustomed to importing. Comparing imports and exports over the past 50 years reveals that we have consistently fallen short in meeting the cost of imports with the revenue generated from our exports.”

He continued, “In only six to seven years of these last 50 years have we seen a surplus. We have consistently borrowed money to pay for our imports, akin to using multiple credit cards to sustain a certain lifestyle without possessing the funds to pay off those credit card bills. Now all our credit cards have been maxed out and no one is willing to lend us more money to pay them off.”

The country therefore has had a perennial balance of payment problem for the past five decades.

According to Beg, “Friendly countries lent us money, artificially stabilising our currency. We received US aid during the Ayub, Zia and Musharraf eras. We can look back and say that our economy was robust. However, it was like an athlete on steroids and now they are realising their body is quite dysfunctional.”

In essence, Pakistan never developed the capacity to earn dollars or pay for imports because someone would always bail us out. Now that America’s vested interest in providing aid has greatly diminished and others have recognised Pakistan’s pattern of dependency, all the usual suspects are hesitant to offer further assistance.

Beg also emphasised how our reliance on aid and loans has hindered our development of productive forces to generate dollars through sources other than bailouts. And now there is a shortage of forex, so demand for dollars is sky-high while supply is negligible.

But how does gold fit into this equation between rupee and dollar?

Well, the government is desperately trying to hold onto the few foreign reserves that it has left, which is why it has taken some drastic measures (administrative and otherwise) over the past year to stop haemorrhaging the greenback. That leaves the open market, but there are restrictions there as well that hinder supply in addition to the bid/offer being not only wider but higher than the interbank rates.

Another option is to utilise the hawala system. Beg explained how this might not be the best alternative either. “Some individuals may have the option to use the hawala system if they have a bank account in Dubai or a similar location. They can obtain foreign currency in exchange for their rupees without leaving a digital trail to track the movement of currency. However, not everyone has this luxury. Furthermore, the recently imposed FATF has made money transfers even more challenging, leaving people with no choice but to seek other ways to protect their wealth.”

This is where gold comes into play.

“The uncertainty surrounding the rupee and the unavailability of dollars is causing people to turn to gold, which has now become the only other acceptable currency after the dollar,” shared Beg.

But gold does not come with its fair share of challenges.

Is gold the knight in shining armour that we think it is?

Pakistanis take the adage ‘not all that glitters is gold’ very seriously because we are cognisant of how easy it is to be duped into purchasing counterfeit or impure gold. Superficially, safeguarding your depreciating currency through gold might seem like a million dollar idea. However, as we hail from Pakistan, we wouldn’t recognise a million dollars if it struck us in the face.

As we have already established, Pakistan’s gold market is not formally regulated. It is difficult to ascertain whether the gold you purchase is pure and authentic. Moreover, there is also the apprehension of being burglarised, so it is not secure to retain large quantities of gold in your home either. Nevertheless, people are still procuring it.

In order to safely invest in gold, people seek branded and trustworthy traders. This is where ARY enters the scene, but we will address that shortly.

Firstly, let’s examine why gold might be a precarious investment. Gold prices are highly volatile and, unlike the dollar, gold prices in Pakistan are not purely defined by its trade in the Pakistani market. The rates we obtain for gold here are directly linked to the international rates at which gold is trading. As a result, fluctuations in global gold prices also impact Pakistan’s gold market.

Beg informed Profit that “The international price of gold is elevated right now due to the war in Ukraine. If there is an armistice tomorrow, gold prices will dip. If gold is trading at $1,990.30 today and then plummets to $1,500, the international price will translate into the gold market in Pakistan. I will awaken to discover that the gold I purchased for around Rs 570,000 is now worth Rs 426,000. I was safeguarding myself from the depreciating rupee but fluctuating international gold prices can still result in me being a loser.”

However, no matter how much gold prices may plummet, the downfall will not be as rapid or as significant as the rupee’s depreciation. But ultimately, gold is not the best investment.

What’s happening in the gold market?

What transpires when panicked masses all rush towards gold in a desperate attempt to evade going down with the rapidly collapsing economy? A shortage of gold emerges.

Haji Haroon, CEO of Chand Gold, informed Profit that “Our imports have ceased due to recent restrictions, lack of foreign reserves and the skyrocketing dollar rate.” He elaborated that it has become unfeasible to import non-essential products, resulting in a diminished supply of gold.

“Individuals are retaining their gold because it would be imprudent to sell when the rupee is anticipated to decline further,” Haroon shared.

He continued, stating that “The purchasing power of customers has suffered due to inflation and economic crisis. The gold we sell is predominantly in Dubai. Despite the imminent wedding season, jewellery is barely selling. We primarily sell gold bars, coins and nuggets to safeguard savings. With Eid and Ramadan coupled with hyperinflation, no one is in a position to spend on jewellery.”

Raihan Merchant, CEO of Z2C Limited, a prominent advertising agency based in Karachi, highlighted another reason for the current gold shortage. “Gold, over the last two years has become a commodity in which people can hoard money. Instead of keeping 20 crore rupees in cash in my house, if I can’t deposit that money into a bank account since it comes from questionable sources or it is money that I haven’t declared in taxes, gold is a very easy way to park this money. Imagine the size and volume of that kind of money, it is not easy to store. When I keep it in the form of gold it becomes convenient and safe to store. So the supply is not just short because demand might be rising but also because many people also hoard gold to park their black money”, he explained,

One thing is certain: what is transpiring in the gold market is expected and common in an economy headed towards default.

ARY’s deus ex machina moment

For anyone looking to make gold jewellery, it is typical to go with someone trusted whom they know to be authentic and good at the ‘making’ part of it. Similarly, a buyer purchasing pure gold as a means to preserve the value of his cash, will go with a reputable brand and ARY meets that requirement.

As with any brand, it takes time and money to develop. This is a major barrier to entry for other gold traders to replicate the ARY model, they don’t afford such a marketing exercise. ARY had the right idea at the right time and stuck with it.

‘Swiss’ is another brand of gold which is not local, not readily available and therefore open to counterfeiting, but is the only other name associated with gold bars, ‘biscuits’ as they’re colloquially referred to here. This in turn gives ARY an added layer of authenticity and preference.

In the absence of trustworthy gold traders, people turn to the few branded and reliable sellers. ARY stands out with their branded gold bars featuring a scannable QR code, assuring customers of their gold’s purity and authenticity.

Profit asked Atiya Zaidi, Managing Director and Executive Creative Director of BBDO Pakistan, to explain ARY’s branding strategy. “ARY hasn’t done anything novel. It may be unprecedented in Pakistan, but globally even precious metals and gems have been branded. Take Tiffany & Co., for instance; research indicates that women’s heart rates escalate just by looking at those infamous tiny blue boxes!”

From a marketing perspective, ARY has essentially undertaken category development. “ARY accomplished this feat because it is already a renowned brand. Everyone is cognizant of it due to their media channels. They are reputed for veracity when it comes to news. So, ARY is not merely a gold brand or a jewellery store; it is a house of brands with an established image and reputation,” Zaidi shared.

Merchant had a similar response: “Purely from a branding perspective, when you want to engender trust with a product, you affix a brand name to it, which is precisely what ARY did. They have been doing it since 2000-2001. As ARY established its brand and became a household name, they were able to augment their premium.”

“If you go to Dubai, no one will consider ARY gold to be the preeminent choice but gold from other brands, like Swiss, will be readily available and they levy an even higher premium than ARY. So, this phenomenon of ARY gold is specific to Pakistan because there aren’t many options to procure authentic gold,” Merchant concluded.

When asked why other gold traders have failed to brand their gold, Zaidi informed that previously gold did not necessitate branding because it would sell regardless. “Gold is perpetually in demand. You need advertisements where there is surplus supply and you need to engender demand for it. Gold is already in such high demand since it is an integral part of our culture that no one felt the need to brand it.”

Merchant echoed this assertion by saying: “Branding is costly. Brand building requires investment consistently over a time along, with lucid vision and positioning. ARY couldn’t levy the same premium as today 20 years ago. So you cannot simply commence charging a premium, without investing years of effort and money into it to first establish trust.”

Now that there is a need for branded gold because people are desperate but sceptical about what they are buying there is just one credible seller resulting in the current shortage of authentic gold bars in the market.

Zaidi highlighted that, “Gold traders will need to brand their gold, like ARY did, when the market is stagnant and they will need to engender demand. Then everyone will concentrate on brand building and advertising.”

Caught in a treacherous double bind, Pakistanis are desperately seeking to safeguard their savings from the rapidly depreciating rupee. But as the market’s dollars vanish before their very eyes, they are confronted with an insurmountable obstacle: The alarming decline in their ability to acquire authentic gold bars. The chaos of the current economic downturn engulfs them all in its deadly vortex of despair and hopelessness, leaving them reeling and gasping for air.

How My Stolen Cryptocurrency Was Recovered

Hello to Everyone. I’m Hayato Hiroshi from a reputable recovery company, and I recommend WebShell for all cryptocurrency recovery requirements. I would currently be without a place to live and be heavily in debt if WebShell hadn’t assisted me in recovering all the money that had been stolen from me through bogus bitcoin investments.I genuinely appreciate his help and professionalism in making sure I get everything back, whether I’m at home, in jail, or both. After reading their message, I contacted them and protested about being a victim of a fictitious cryptocurrency and FX investor. Within 48 hours, all of the money that had been taken from me using Bitcoins had been restored. I wholeheartedly recommend their service to anyone who may have

WebShell can be reached via Email / WhatsApp at

([email protected])

+13195191428.