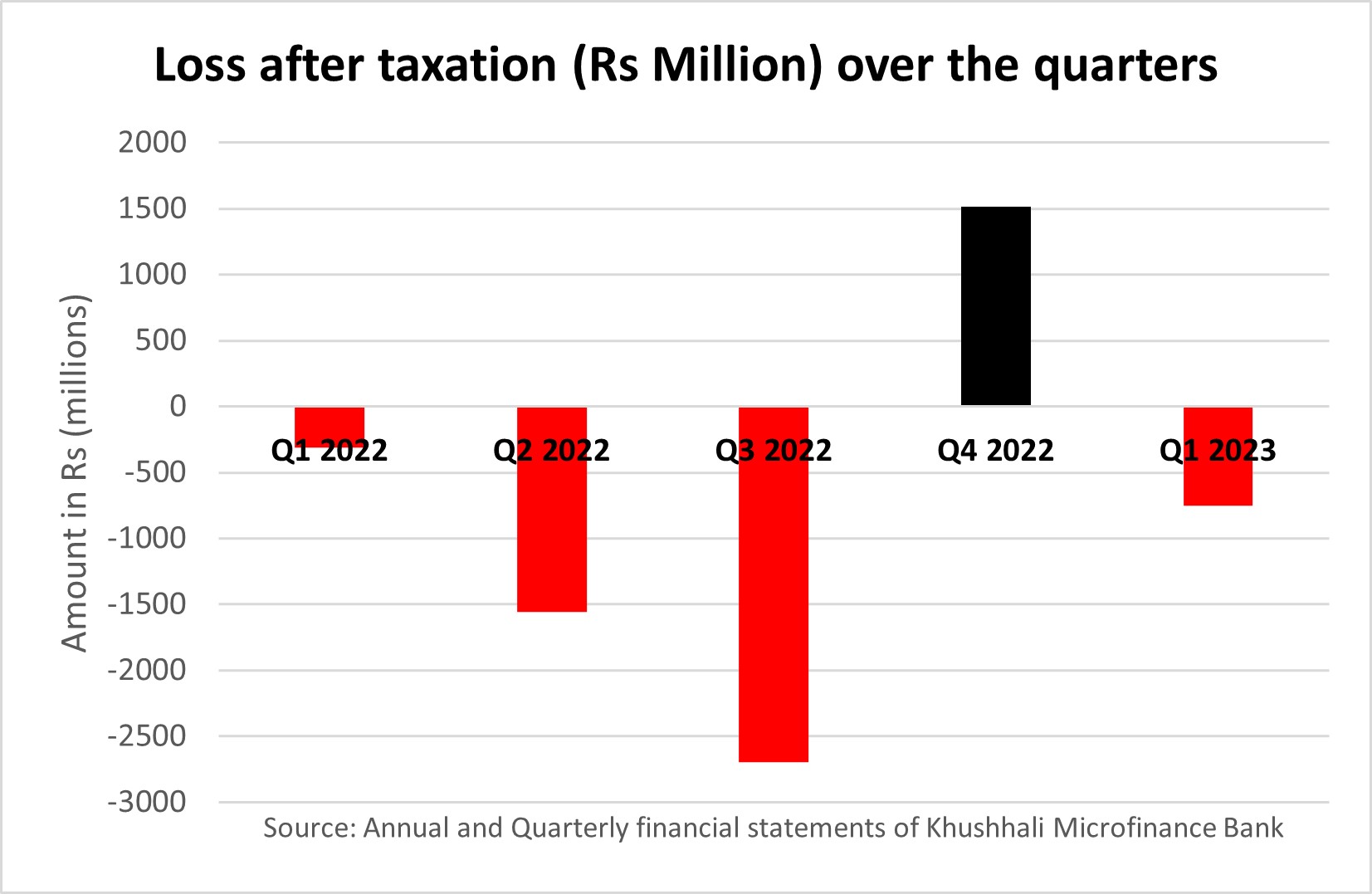

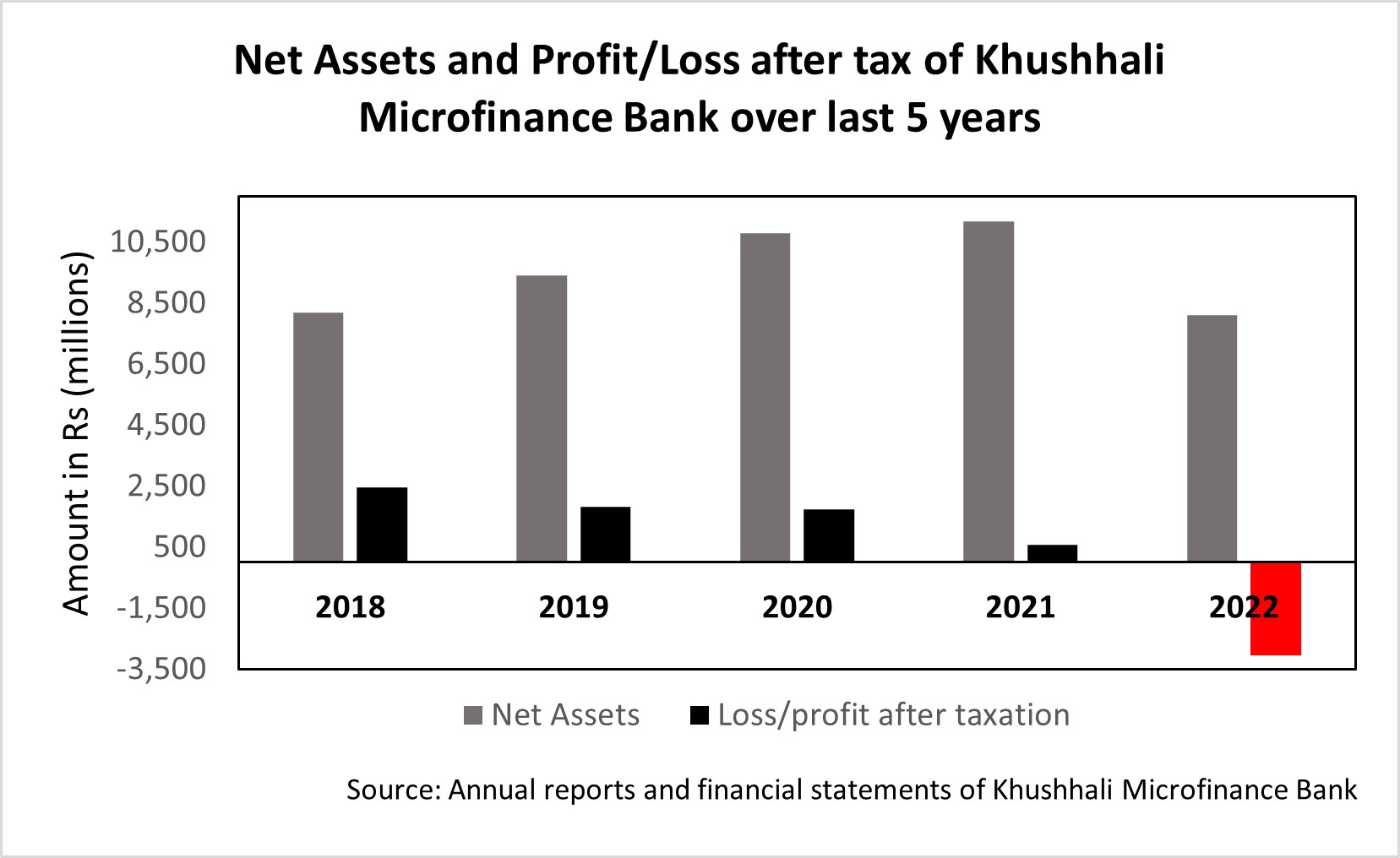

When Khushhali Microfinance Finance Bank (Khushhali bank) released its latest financials for the first three months of 2023, it reported yet another quarter of losses. Even before this, it was clear that the bank was in trouble. Continuous haemorrhaging in the last year had wiped off a big chunk of the bank’s equity capital. And now the bank seems to be scrambling to find Rs8 billion in fresh capital. To put this number in perspective, it takes Rs10 billion to set up a brand new commercial bank in Pakistan. That is right. With another Rs 2 billion the potential investors could instead open, not a microfinance bank, which has limitations on what it can and can not do, but a full service commercial bank!

What this also means is that if Khushhali bank is unable to find willing investors soon, the State Bank of Pakistan (SBP) might have to come in and do what it did with KASB bank in 2015.

But before the fresh capital comes in (if it ever does), Khushhali Bank has taken one decision that is causing considerable pain to one set of investors. The decision to forcefully convert Rs1.5 billion of Additional-Tier 1 bonds (ADT1), which are a special type of debt instruments, into equity capital. In simple words, investors in these Khushhali bank bonds were hoping to enjoy fixed interest payments, while now they are being forced to become shareholders, expected not only to give up the interest income on these bonds, but also to share any future losses of the troubled bank. The investors are obviously not happy and feel short changed. But more on that later.

At Profit we feel it is our responsibility to raise issues in the corporate world where there are concerns of possible financial wrongdoing, but this story is more important than just that. The outcome of how regulators handle the first ever conversion of this sort could be much more significant, not just for the newly introduced ADT1 bonds asset class, but also for the larger development of Pakistan’s capital markets, and in turn our economy. What makes all of this more interesting is that very similar cases in the courts of Switzerland and India regarding Credit Suisse and Yes Bank are already underway, making Pakistan, with this story, the third country where this issue is being discussed.

But first what are ADT1 bonds?

What are ADT1s? (skip if you already know)

Additional Tier 1 Term Finance Certificates/bonds (or ADT1 bonds) are a type of debt instrument (loan) issued by banks to meet regulatory capital requirements. These were introduced as part of the Basel III framework, which was implemented in response to the 2008 financial crisis. The main objective of Basel III was to make the global banking system stronger by increasing the quality and quantity of capital that banks hold, so that in future banks do not need their governments to bail them out. Thus, ADT1 bonds enhance the loss-absorption capacity of banks and provide a safety net to protect depositors’ money in case of financial stress.

The key features of ADT1 bonds include:

- Perpetual Maturity: ADT1 bonds don’t have a specific maturity date when the money has to be paid back to the bondholder. They can last indefinitely, but the banks that issued them may have the option to pay them back after a certain period if they want.

- Discretionary Interest Payments: The payment of interest on ADT1 bonds often depends on the bank’s profitability and availability of distributable funds. If the bank’s financial performance deteriorates, it can defer interest payments on ADT1 bonds.

- Loss Absorption and conversion into shares: ADT1 bonds are designed to absorb losses if the bank faces financial difficulties or is failing and thus goes through a resolution process. In such situations, the bondholders may experience a reduction in the amount they will be paid back (principal) or their debt may be converted into ownership shares (equity).

- High Yield: ADT1 bonds generally offer higher interest rates (yields) compared to other types of loans because they carry higher risks. These risks come from the possibility of loss absorption and because ADT1 bondholders are in a lower priority position compared to other forms of debts, and might not be paid back in full if a failing bank’s assets fall short of its other debt obligations.

The capital buffer required by banks is divided into two tiers and must meet certain minimum levels. Tier 1 capital is made up mainly of equity, referred to as Common Equity Tier 1 (or CET1), while Tier 2 capital can be made up of debt securities such as bonds and Term Finance Certificates (TFCs).

ADT1 bonds lie between equity CET1 and Tier 2 debt and are considered a distinct category as they can be converted into common equity (CET1) to fulfil regulatory capital requirements.

In terms of hierarchy, Tier 2 instruments rank higher than ADT1 instruments which rank higher than Common Equity Tier 1. In other words, CET1 is subordinate to ADT1, which in turn is subordinate to Tier 2. In the event of a resolution or insolvency, these instruments absorb losses according to the hierarchy of their positions. This means that common equity instruments (shareholders) are the first to bear losses. Only after these instruments have been fully utilised would Additional Tier One instruments, like our ADT1 bonds here, be subject to write-downs, followed by Tier 2 capital instruments. In simple terms, the order of absorbing losses starts with common equity, then moves to ADT1 bonds, and finally to Tier 2 capital instruments.

Triggers

As mentioned earlier, ADT1 bonds can be converted into equity or can be written off if the capital ratio of the issuing bank falls below a predetermined threshold. Such an event activates the contingency plan, enabling the option of conversion of these debt instruments into equity.

As per Basel III requirements and as also directed by the SBP the ADT1 bonds are convertible under the following contingent scenarios:

- Point of Non-Viability Trigger Event (PONV Trigger Event): This event occurs when the SBP determines that it is necessary for the Issuer (Khushhali bank in this case) to either convert the bonds or permanently write them off to prevent a troubled bank from defaulting on obligations towards its depositors. It can also be triggered if there is a decision to inject capital or provide equivalent support from the government to prevent the bank from becoming non-viable. The SBP has the authority to declare the PONV Trigger Event at its discretion.

- CET 1 Trigger Event: This event is triggered when the Issuer’s Shareholders’ Equity Tier 1 (CET1) ratio falls to or below 6.625% of Risk Weighted Assets. When this happens, loss absorption through conversion is initiated. Risk-weighted assets are mainly the loans that the bank has made, weighted (that is, multiplied by a percentage factor) to reflect their respective level of risk of loss to the bank.

- Lock-in Event: Mark-up will be paid from the Issuer’s current year’s earnings and if the Issuer is in compliance with regulatory Minimum Capital Requirement and Capital Adequacy Ratio requirements set by SBP. Not exercising the lock-in clause may result in conversion of these ADT1s into ordinary shares or write-off at the discretion of SBP.

The Saga: Khushhali bank issues ADT1 bonds for Rs 1.5 billion face value

Khushhali bank issued Rs1.5 billion fully subscribed face value ADT1s on June 16, 2022. The instrument was perpetual with profit payable every six months and priced at 6M Kibor+4% and was callable at par after 5 years. The instrument had lock-in and loss absorption clauses.

Initial ratings

Such instruments are required to be rated before they can be issued. Khushhali bank solicited Pakistan Credit Rating Agency (PACRA) to issue the rating for the instrument. In its May 24, 2022, rating report, PACRA rated the ADT1 instrument as A-. While VIS Credit Rating Company (VIS) didn’t rate this particular ADT1, its May 6, 2022 rating report rated Khushhali bank as A+ and two previous Tier 2 TFCs issued by Khushhali bank as A.

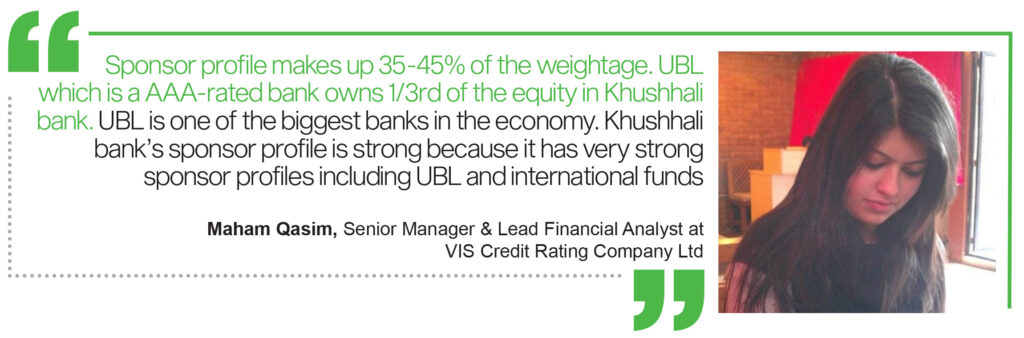

Explaining the rating, Maham Qasim, Senior Manager & Lead Financial Analyst at VIS Credit Rating Company Ltd said “TFCs are shadow ratings of the entity. When we rated Khushhali Bank at A+ in April 2022, we had to rate the TFCs in relation to entity’s rating”.

Both rating entities, the PACRA rating and VIS rating, issued reports only a month before the ADT1 subscription and highlighted the risk of the restructured portfolio yet find comfort anticipating support from the sponsors (mainly UBL).

However, both rating agencies also expressed concerns on the recovery of deferred loans. VIS rating explicitly stated the bank’s management has aggressive assumptions with respect to the double restructured portfolio as the bank had set an ambitious recovery target of around 80% on the portfolio rolled over under SBP’s relief which it did not think was possible.

The ADT1 Investors

The consortium of investors in the ADT1 include:

- The Bank of Punjab (BOP)

- BOP Employees Gratuity Fund,

- EFU Life Assurance Limited,

- National Bank of Pakistan,

- Pak-China Investment Company Limited,

- United Bank Limited

- U Microfinance Bank Limited (UBank),

- Askari Bank Limited,

- Askari Bank Limited Employees Provident Fund and

- Khushhali bank Employees Gratuity Fund

UBank subscribed to 15% of the issue amounting to Rs 225 million as per their September 30, 2022, financials. The rest of the investors either don’t have public financial statements or do not provide details of this investment in their financials.

The most surprising part is that ADT1 bonds are the first line of defence when an entity is hit by lack of capital. Both rating entities had flagged concerns surrounding the loan portfolio of the bank. Besides, the relief provided under the SBP program has now ceased. In such a situation, it is only natural for investors to be vigilant and seek reassurances or guarantees from the bank, particularly regarding the troubled loan portfolio.

June 30, 2022 Financials of Khushhali bank

March 2022 financials would have been the latest public financials available to ADT1 investors. According to these financial statements, Khushhali bank had charged Rs1.25 billion of specific provisions against their loans. However, in the June 2022 financials, the year-to-date specific provisions had increased to Rs3.3 billion implying that Khushhali bank accrued additional specific provision of around Rs 2 billion in the period April-Jun 2022. Net Assets including CET1 stood at Rs10.8 billion

According to the June 2022 financials, which were just 14 days after the ADT1 issue, Net Assets (including CET1) dropped to Rs 9.3 billion.

Were the investors aware that they are looking at a reduction in the equity in 14 days which is almost equal to the ADT1 amount?

| March 30, 2022, Financial Statement | June 30, 2022, Financial Statement | ||

| Equity Capital | Rs10.8 billion | ADT1 | Rs 1.5 billion |

| Equity + ADT1 | Rs10.8 billion | Equity Capital | Rs9.3 billion |

| Equity + ADT1 | Rs10.8 billion | ||

It is impossible that Khushhali bank’s management was unaware of the true financial position of the bank 14 days before the date of the financial statement i.e., June 30, 2022, and this loss and reduction in equity came as a surprise to the management. If the management was aware of this, it is expected that this information was shared with investors when they were investing in ADT1s. If the management was unaware of the magnitude of this loss two weeks before the half-year close, then this raises questions about the governance systems in place at Khushhali bank, a fact which will be of relevance when we discuss the Yes Bank case later.

Profit reached out to Aameer Karachiwalla, President and CEO of Khushhali Microfinance Bank to ask whether investors were made aware of the true financial position when investment was solicited.

“The process for ADT1 issuance was initiated in late 2021. IM (Information Memorandum) including 5 year Forecast along with portfolio analysis were provided to the consortium/ ADT1 investors. Additional information as and when required and financials of the bank were also available to the consortium on our website duly approved by the Board. The ADT1 issue was also rated by PACRA, a leading rating agency.

The portfolio deterioration caused by Covid was well known to the investors prior to drawdown in Q2, 2022, as the COVID related rollovers started maturing and were later compounded by floods in the country. This double calamity caused unprecedented losses that were not in our earlier forecasts. These losses eroded the CET1 to levels triggering the predetermined point for conversion under the SBP regulations. The conversion of ADT1 to equity is a contractual event/term and does not reflect Khushhali Microfinance Bank’s inability to service these TFCs”, declared Karachiwalla

However he still doesn’t answer whether the investors knew about the loss that came on June 30 when they advanced the money on June 16.

PACRA and VIS December rating

In December 2022, PACRA issued the credit report mentioning that Khushhali Bank has invoked the Lock-in clause. According to the terms of TFCs and Lockin clause, neither profit nor principal is payable if the required levels of capital fall short then specified by the SBP. This means that not a single profit payment was made on this ADT1 that was issued on June 16, 2022.

Despite this, PACRA maintained the rating of TFCs at A- but with a negative outlook. Unfathomable why PACRA is maintaining the rating considering the bank’s capital didn’t increase despite issuance of ADT1 and the bank could not even make first profit payment on the recently issued ADT1.

VIS also issued its rating report in December in which it downgraded the two Tier II instruments two notches from A to BB- due to deteriorating financial health of the bank leading to a negative impact on its profits and capital position. Capital adequacy ratio (CAR) decreased below the required minimum set by regulators. Moreover, SBP had activated a lock-in clause. This means that the bank is not allowed to repay any debts covered by the lock-in clause during the period specified.

We can hypothesise what happened here. First, Khushhali bank wrote to SBP that they have breached the Basel III requirements as imposed by SBP and are invoking the lock-in clause for ADT1s (holding off the payment of the first markup on ADT1) whilst also seeking an approval from SBP to pay the markup. Therefore, PACRA maintained the rating on ADT1 at A-. However, SBP took it a step further and asked Khushhali bank to invoke the lock-in clause on Tier II instruments as well. Seeing this VIS downgraded the Tier II TFCs by two notches to BB-. Thus, at the end of December, the subordinate instrument ADT1 was rated A- while Tier II instruments which rank above ADT1 were rated two notches below, at BB-.

2023 Ratings

At the end of January 2023, PACRA in its rating report finally brought down the rating of the ADT1 to BB because of invoked lock-in clause and debt repayment of Tier-I instrument was not made.

In its April 2023 rating report, VIS dropped the long term rating of Khushhali bank from A to A-. This downgrade came because Khushhali Bank’s capital fell below the required levels and the microfinance bank lost its market leader position during the ongoing year.

And as stated earlier, the lock-in clause had been invoked on the Tier-II instruments of the Bank by SBP thus preventing any debt repayments. But the ratings still stood at A- because of strong sponsor profile and implicit support of shareholders.

However, the rating agency put the bank on rating watch negative which means that the bank’s ability to pay off its liabilities is deteriorating. The report stated that the actual non-performing loans (NPL) percentage, which is the proportion of loans not recovered, is likely to exceed the one provided by the management as current recovery rate was lower than anticipated. Moreover, the bank had missed payments for two instruments under rating review with TFC-1’s first mark-up payment missed on 19th March, 2023 and two markup payments of TFC-2 have been missed, dated 27th Dec 2022 and 27th March 2023. Given that it is highly unlikely that the Bank will be able to replenish its equity shortfall during the ongoing year; therefore, further missed payment instances are expected. Subsequently, the risk of conversion of both instruments into common equity is on the higher side.

Two points need to be emphasised:

- Before the ADT1 issue, in their May 6, 2022 rating report, VIS mentioned that Khushhali bank management was projecting an 80% recovery rate on the double restructured portfolio. A double restructured portfolio refers to loans or credit facilities that have been modified twice due to financial difficulties faced by borrowers. VIS pointed out that recovery rate was unrealistic. Almost a year later, in its April 2023 rating report, VIS notes that the actual recovery rate was much lower at 49%. In VIS’s opinion, Khushhali bank is still under-reporting NPLs.

- The rating report, however, VIS does not mention that the auditors have raised doubts about the ability of Khushhali bank to continue as a going concern in the Dec 31, 2022 financial statement.

Qasim from VIS retorted saying “We are not auditors, we are not going to comment on whether an entity is a going concern or not”.

Khushhali bank breaches the CAR threshold and has doubts raised about its going concern nature

The bank issued its financial statements for the year 2022 at the end of April 2023 in which it declared a loss of Rs 3 billion on account of significant losses incurred by it on its lending portfolio.

Under the SBP COVID relief guidelines, Khushhali bank rescheduled loans of approximately Rs 35 billion. At the reporting date, the rescheduled portfolio had reached maturity. But cash recovery stood at 49% (Rs 17 billion). The bank further rescheduled 31% of loans(Rs 11 billion) and wrote off 20% of loans (Rs 7 billion). Given the losses on rescheduled loans, Bank’s capital adequacy ratio (CAR), at 11.50%, fell below the regulatory requirement of 15% at the reporting date.

Consequently, auditors raised doubts about the ability of the bank to continue as a going concern which means that the bank does not have enough assets to pay off its liabilities.

Therefore in April 2023, the Khushhali bank’s board of directors gave approval for conversion of Rs1.5 billion ADT1 bonds to common equity to increase its capital levels to meet the required capital levels. The Bank’s financing agreements for ADT-1 capital contain a loss absorption clause, whereby, the Bank can convert this subordinated loan into common capital, under a mechanism established pursuant to provisions of Basel-III guidelines issued by SBP, if the Bank’s Loss Absorbency Ratio (LAR) falls below prescribed benchmark.

Analysing the issue

As mentioned earlier, there is no precedent for such a transaction in Pakistani capital markets. As such, the matter discussed here will not have been touched upon previously. There are three key matters that need to be discussed:

- Hierarchy of claims and write-downs

- Governance (or lack thereof) and projections when making representations for issuing ADT1s

- Rating’s reliance on sponsor support which never arrived.

1. Hierarchy of claims and write-downs

As per the terms of the ADT1 given in the information memorandum of the ADT1, the maximum number of shares to be issued to TFC holders at trigger is 24,941,038 ordinary shares, or as specified by the SBP

The cap on the maximum number of shares that can be issued places the ADT1 investors at a disadvantage with respect to the equity holders. The book value of the shares as of December 31, 2022, is Rs 47.6 per share.

| Net Assets as of Dec 31, 2022 | Rs | 8,109,253,000 |

| Number of shares outstanding | 170,500,000 | |

| Book value per share | Rs | 47.6 |

As per the terms of the teaser, the ADT1s will be converted to shares at a price of Rs 60.1 per share

| Face value of ADT1 outstanding | Rs | 1,500,000,000 |

| Number of shares to be issued | 24,941,038 | |

| Per share price for conversion of ADT1 | Rs | 60.1 |

Once the conversion happens, the Net Assets of the bank will increase by Rs 1.5 billion and number of shares will increase by the new shares. The new book value will be Rs 49.2 per share.

| Net Assets after conversion of ADT1 | Rs | 9,609,253,000 |

| Total number of shares | 195,441,038 | |

| Book value per share after conversion | Rs | 49.2 |

The ADT1 investors are getting a share at a price of Rs 60.1 per share when the actual value per share is Rs 49.2. The value per share of common equity before the conversion was Rs 47.6 and after the conversion, it increased to Rs 49.2. What we see here is that common equity holders gaining at the expense of ADT1 investors and ADT1 holders recognizing a write-down or partial write-off of Rs 273 million on their investments.

| Number of shares awarded to ADT1 holders | 24,941,038 | |

| Book value per share after conversion | Rs | 49.2 |

| Total book value of shares given to ADT1 holders | Rs | 1,226,276,460 |

| Face Value of ADT1 | Rs | 1,500,000,000 |

| Write down / partial write off | Rs | -273,723,540 |

Earlier we mentioned that the AT1 instruments rank ahead of CET1 and behind T2 in the hierarchy.ADT1 rank ahead of common equity. If the common equity holders, which are subordinate to ADT1 investors, are not getting their equity written off, it is unacceptable that the ADT1 investors should get a write-off.

This principle was recently emphasised by the Bank of England, the European Bank Authority with ECB, and the Monetary Authority of Singapore in the aftermath of Credit Suisse AT1 write-offs.

All three of these institutions emphasised that AT1 instruments rank ahead of CET1 and behind T2 in the hierarchy. Holders of such instruments should expect to be exposed to losses in resolution or insolvency in the order of their positions in this hierarchy. This means that common equity instruments are the first ones to absorb losses, and only after their full use would Additional Tier One be required to be written down followed by Tier 2 capital instruments.

But in the case of Khushhali bank, ADT1 instruments are being converted into equity in a manner that ADT1 investors will bear a partial write-down (loss) before the common shareholders.

2. Governance (or lack thereof) and masking of losses when issuing ADT1s

Earlier we hinted at a possibility that either there was a lack of governance at Khushhali bank or a wilful masking of losses, as the financial statements issued 14 days after the subscription of ADT1s show a different picture to the one based on statements available before the subscription. This is also substantiated by VIS commenting that Khushhali bank is projecting unrealistic recovery targets of 80% on the double-restructured portfolio. Even now, Khushhali bank is underestimating NPLs as per VIS.

The case of Yes Bank in India provides a good case study for such a scenario. In 2020, Yes Bank collapsed due to various scandals involving questionable investments, high upfront charges, undisclosed non-performing assets (NPAs), and banking frauds like money laundering. The Reserve Bank of India (RBI) imposed a moratorium on the bank and appointed an administrator. Initially, a draft reconstruction scheme was released, which included the write-off of Additional Tier-1 (AT1) bonds. However, the final scheme, approved by the Central government, removed this provision.

Despite the removal of the provision, the administrator wrote off AT1 bonds worth INR 84.2 billion on March 14, 2020. On January 22, 2023, the Bombay High Court overturned this write-off, stating that the administrator exceeded his powers and authority. Yes Bank and the RBI appealed the Bombay HC’s decision in the Supreme Court, and the stay granted by the Bombay HC was extended by the apex court.

Investors have filed affidavits in Supreme Court highlighting governance lapses by Yes Bank. They argued that the decision to write down the bonds was flawed and the RBI did not consider the bank’s violation of financial rules when supporting the write-down in court.

An often-overlooked footnote in the RBI master circular states that a bank may also become non-viable due to non-financial problems, such as the misconduct of affairs of the bank in a manner which is detrimental to the interest of depositors, poor governance issues, etc. In such situations raising capital is not considered a part of the solution and therefore, does not fall under the provisions of this framework. This means that if a bank has hidden losses and deceived investors, a write-down may be difficult to justify. Yes Bank, for instance, faced allegations of masking losses and misleading investors, which resulted in the removal of its CEO and changes in the board of directors. Two AT1 bondholders of Yes Bank believe that this provision supports their argument that the write-down was illegal and against regulations.

The outcome of the ongoing legal battle between bondholders and the RBI remains uncertain, as the court will have to consider the allegations of governance lapses and the bank’s misleading actions in the context of the AT1 bond write-down.

3. Credit Rating’s reliance on unreliable sponsor support

When granting the A- rating, both PACRA and VIS relied on and sought comfort from the sponsorship of UBL and expected implicit support from UBL.

“We have 9-10 parameters for rating and the Sponsor profile has the highest weightage. Sponsor profile makes up 35-45% of the weightage actually. (Within the sponsor profile), Number one is the group. And then the willingness and capability of the group and sponsors to help the organisation. UBL which is a AAA-rated bank owns 1/3rd of the equity in Khushhali bankL. UBL is one of the biggest banks in the economy. Khushhali bank’s sponsor profile is strong because it has very strong sponsor profiles including UBL and international funds”, said Qasim from VIS.

However, to date, no support has been given by UBL to the extent that the ADT1 investors who relied on the A- rating are not only looking at a conversion of their ADT1 to CET1 but also a partial write-off. VIS’s

Profit asked Karachiwalla to understand why UBL has not not injected capital in its microfinance subsidiary.

“UBL only owns 29.8% of the Khushhali, and while they fully support the bank, equity injection is a combined activity with the remaining shareholders who are largely foreign funds. You may appreciate raising fresh equity is a time-consuming process, however, the process is at an advanced stage”, commented Karachiwalla.

While Karachiwalla’s statement alludes to positivity, VIS’s April 2023 report shows a different picture altogether. According to the report, UBL, the primary sponsor, has agreed to pitch in funds as per their existing shareholding proportion but are not willing to increase their overall stake in the Bank. The contribution from UBL is expected to range between Rs. 1.9-2.7 billion. Moreover, one of the international sponsors, ASN Novib having an ownership of 10%, has also agreed to inject equity; however, the amount of investment has not yet been confirmed. Nevertheless, ASN NOVIB does not plan to contribute more than their current shareholding proportion. On the other hand, the remaining international sponsors having an aggregate stake of around 60% being closed end-funds have not shown any interest in injecting additional capital in the Bank. On the flip side, the management has approached a Dutch Entrepreneurial Development Bank to buy out the stake of three existing international shareholders. In addition, the management is also hopeful that apart from buyout money the new prospective buyer is also willing to inject additional funds.

Meanwhile, sponsors of other microfinance institutions have provided support to their microfinance institutions most notably Telenor and Alipay injection of Rs 19 billion in Telenor Microfinance Bank between 2020 and 2021, PTCL converting its Rs1 billion Tier II capital provided to U Bank to Tier I and NRSP got Rs1 billion share deposit money from some shareholders.

Conclusion

In light of the issues highlighted above, the conversion of ADT1 isn’t as straightforward as it first appears. If the conversion proceeds as described in the regulations without considering the overarching matters of the hierarchy of claims and governance/financial projection, this may kill the market of ADT1 as no investment manager who values his career will recommend investing in such an instrument. This will have a direct impact on the future of the stability of our financial system, which is already under distress. Not just because many bank borrowers might just default on the back of record high interest rates, coupled with a slowing economy, but also because there are talks of the government also defaulting on its domestic debt obligations to the banks. Moreover, this raises the issue of how much value to give to credit ratings when the rating is deriving comfort from the implicit support from sponsors which sometimes never arrives.