Tokenized securities must follow existing securities rules, a U.S. securities regulator said on Wednesday, as more firms explore blockchain-based models for trading.

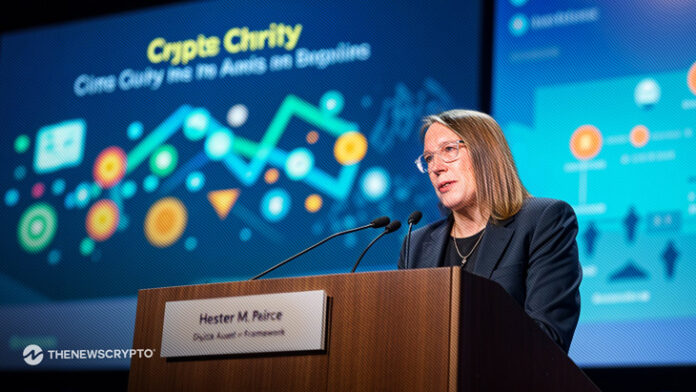

Hester Peirce, a commissioner at the Securities and Exchange Commission, said digital tokens that represent ownership in stocks or other assets do not change the legal nature of those assets. “As powerful as blockchain technology is, it does not have magical abilities to transform the nature of the underlying asset. Tokenized securities are still securities,” she said.

Tokenization involves converting shares of a company into digital tokens that can be traded on a blockchain. These tokens can be issued by the original company or by a third party.

Peirce said investors could face special risks when buying third-party tokens.

Companies in the crypto and finance sectors have been discussing tokenization as a new method of trading. Coinbase recently said it is seeking approval from the SEC to offer stocks through blockchain.

SEC Chairman Paul Atkins said last week the agency should support innovation, including new models like tokenization.

Some critics warn that the practice could be used to avoid SEC oversight and create new risks for individual investors.