Pakistan’s foot traffic is on a double digit decline. While the country has gone on a rollercoaster ride of lockdown, smart lockdown, no lockdown and smart lockdown again ever since the outbreak of the Covid-19 pandemic, the overall effect on footfall has been overwhelmingly negative.

Data from the latest COVID-19 Community Mobility Report from Google, which measures an aggregated and anonymized dataset of Android phone users who have chosen to leave location history on, shows Pakistan’s foot traffic has fallen across five categories. Retail & recreation, supermarkets & pharmacies, parks, public transport, and workplaces saw noted drops in activity by 28pc, 16pc, 8pc, 24pc, and 26pc respectively in the five categories.

While the decrease in footfall is slightly encouraging from the point of view of containing the pandemic in the country, it is clearly a blow to the country’s very traditional, brick-and-mortar store economy. It also presented a great opportunity for eCommerce to seize the day. While eCommerce, like everyone else, were caught unawares, the Covd-19 pandemic may end up causing a seismic shift in how we shop. This is perhaps best illustrated by grocery shopping.

According to Profit’s analysis of Household Integrated Economic Survey (HIES) and Pakistan Social and Living Standards Measurement (PSLM) data borrowed from the Pakistan Bureau of Statistics (PBS), consumer spending on groceries was approximately Rs6,540 billion ($48 billion) in Pakistan, approximately 38.5% of total consumer spending. Profit’s analysis of PBS data suggests that while the city of Lahore accounts for 5.4% of the country’s population, it accounts for 6.9% of total grocery spending in the country.

The data roughly values that the Lahore grocery market was worth Rs451 billion ($3.3 billion) in 2019, one of the fastest-growing ones in Pakistan, a substantial and attractive market for many internet entrepreneurs to jump in and try to disrupt the market and get a slice of the pie in the process.

In Lahore, Imtiaz Supermarket raked in PKR 600 million, PKR 700 million, and PKR 800 million in eCommerce sales during the first 100 days of C19 from its Model Town, Canal Store, and Capital store branches, according to sources familiar with the matter.

On that note, Foodpanda accelerated the launch of PandaMart, its grocery delivery service, competing with dMart by Daraz amongst other market challengers. The launch was accelerated by hiring Brandverse, a one stop solution for cataloguing products for launching an owned eCommerce page.

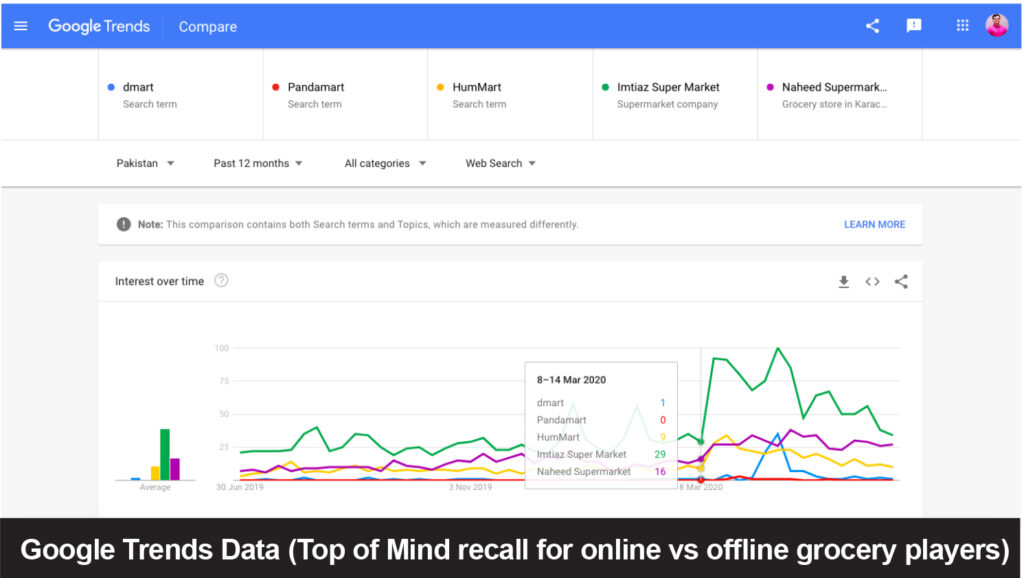

Data on Google Trends shows that both Daraz and Foodpanda grew customer acquisition investments in dMart and Pandamart respectively, while top of mind recall for grocery shopping was led by Imtiaz Supermarket and Naheed Supermarket respectively. The digital first HumMart led the eCommerce category, with organic interest for all three online marketplaces tapering off since May 2020.

“Due to COVID-19, a lot of people are restricting store visits and this has caused a decline in LMT sales across all brands,” said Faizan Syed, CEO of East River. “However this has given a great opportunity to develop the ecommerce sales channel development but still there is a lot of work needed for more internet penetration and getting rid of the trust deficit that was caused by massive internet and phone call scams.”

As he explains, groceries have seen a big rise as consumers are experimenting with online ordering. This could drive a shift to online grocery delivery especially in cities like Karachi where corporate life is prevalent and such delivery services would create ease once work resumes. Profit reached out to five different eCommerce companies to do case studies on how eCommerce has reacted to the Covid-19 pandemic. The overwhelming response has been that this is a time for survival, not to grow and expand, but what these companies do now could shape the post pandemic future as well.

Daraz

Within days of the lockdown, Daraz launched its Humqadam program, which invited Small and Medium Enterprises (SMEs) from across Pakistan to set up their digital ventures on the marketplace platform to reach a large customer base and start selling. The program offered sellers complete business and financial support, which included the waiver of commission fees for the months of May and June. The total investment Daraz made to provide such support amounts to Rs 4.5 crore ($270,000). The first-party data that is generated, on the other hand, will be retained and owned by the company. Essentially, Daraz provided an online platform and mined data in exchange for it.

“Since the lockdown in March, 30,000 sellers have registered for the Humqadam program and 4,576 have been verified and are operational on Daraz,” said Imran Saleem, the Director of Commercial at Daraz in Pakistan. “The program was launched to empower the SME sector, which is critical to Pakistan’s economy, contributing 40% of the GDP and 80% of total non-agricultural employment.”

According to Muhammad Ammar Hassan, Chief Marketing Officer at Daraz, the enforced closure of stores selling non-essential items resulted in a spike in registrations from SMEs and brands seeking a quick direct to consumer channel – without the hassle of spending 90 days creating their own dot com.

In an interview with Hum TV, Hassan shared that within days of the lockdown in place, orders for groceries grew six times for items categorized as personal hygiene, disinfectants, and groceries, with shoppers relying on a third-party to ensure purchases passed every stage of sanitization. The Alibaba-owned marketplace splits revenue between brands and merchants, which make up 35pc and 65pc of its sellers.

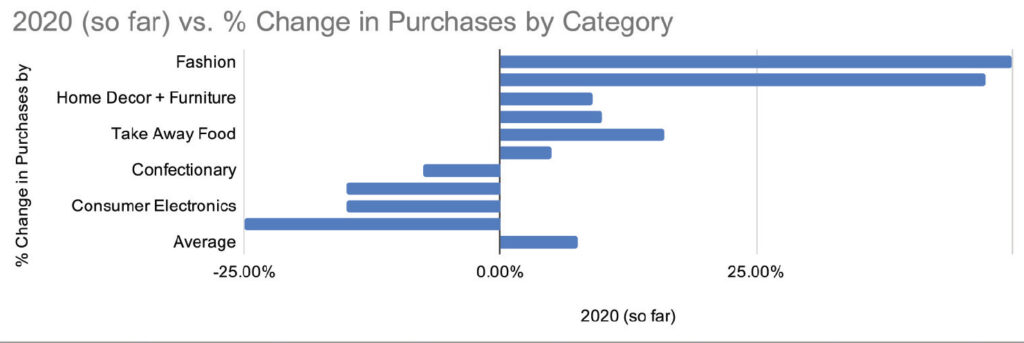

Speaking to Profit, Saleem said that business revenue is currently split across electronics, lifestyle products, CPG, and fashion products at 40pc, 25pc, 20pc, and 15pc respectively. He said that travel and movement related product categories were on the decline, such as luggage, cameras, and drones, due to the postponement of vacations and international travel. Similarly, health products, groceries, and home & living products grew in sales with buying behavior indicating self improvement and home improvement as being important activities people are engaging in during the pandemic.

“Logistics remains tricky right now as we want to ensure the safety of our staff and customers,” said Saleem. “To determine which areas to steer clear of and navigate our planning accordingly is something that we have learned on the go and are rapidly improving our response time to the same. Customers have remained largely understanding of the on-ground situation and that really goes a long way in us planning and executing quick and safe deliveries.”

Yayvo

As an online marketplace backed by a courier service, respondents from Yayvo were the only ones in this survey to complain about supply chain issues. Tanvir Malik, head of operations and vendor management at Yayvo, told Profit that the business did not face any of the conventional challenges related to fulfilment and last-mile deliveries due to its parent company.

“This is the main reason why the unprecedented growth post lockdown allowed us to scale painlessly and we fulfilled quicker than any other online marketplace,” said Malik. “The bottleneck for us was primarily related to readiness of vendors and non-availability of products due to lockdown imposed in March. Because some vendors were closed and their products were not available, this eventually resulted in reduction in the assortment of products that were available on our marketplace.”

Naturally, once the lockdown eased and businesses reopened, these challenges resolved themselves. But the new challenge that arose was some imported items becoming limited in availability due to travel restrictions. Speaking to Profit, Malik lamented that due to uncertainty and limited supply, major brands started operating on a trading model whereby they would receive inventory payment in advance instead of operating on commission model. He said that the trading model does not really fit into the e-commerce market and brands need to realize that commission model is the best win-win to boost their e-commerce sales.

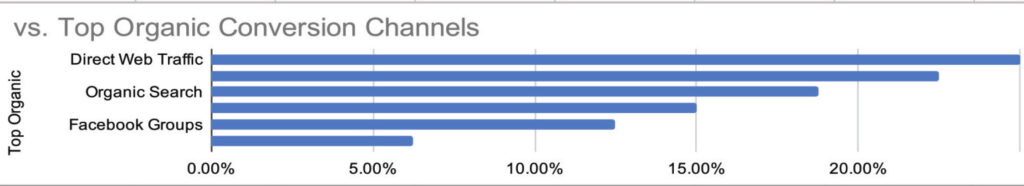

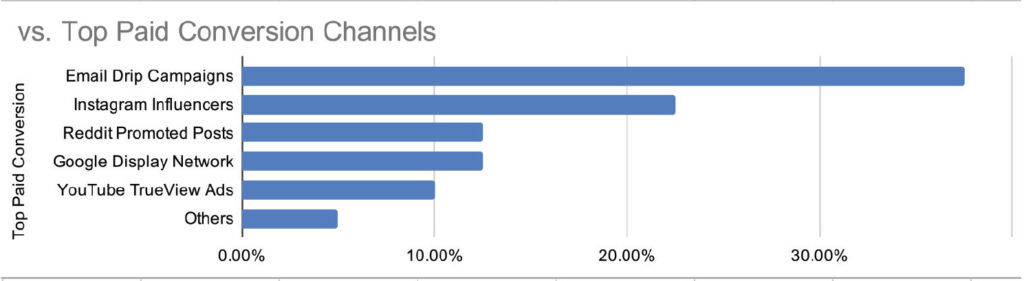

Similar to most respondents to this study, Malik cited social media and search engines as an organic source of traffic that was ready to buy, with the remainder conversion traffic (see data chart) distributed across direct visits, paid media, referrals, branded partnerships and email drip campaigns. He said that while fashion oriented purchases initially fell, all product categories gradually picked up with every passing day of lockdown being eased.

“Categories like appliances, entertainment , fashion saw a decline initially but not a very significant one,” he said. “Tremendous growth was seen in categories like superstore, health and sports, beauty and grooming in initial days and continues on. Some categories picked up pace in later days including mobile, tablets and small electronics.”

Similar to other responses to this survey, Malik added that in the initial days of Covid-19 and the lockdown, the bulk of product orders were for sanitizers, disinfectants, masks, hand washes, and complimentary products, with buying behavior gradually shifting to other categories as the initial panic wore off.

HumMart

Before the lockdown was announced, HumMart had made the decision to cut down its stock keeping units (SKUs) in half, from 11,000 to 6,000 by March. This was to focus on selling most groceries and refuse stocking longtail items.

“There is no major increase in brands trying to sell online,” said Farzadaq Ali Shah, strategic planning manager at HumMart. “We saw a surge in brands contacting us for collaborations and increasing sales online. Earlier it was predominated by [MNCs] like Unilever and P&Gs of the world but now local brands have started showing interest in selling online, with the likes of Hilal Foods, Stillman, and others contacting us to increase footprint online.”

Shah told Profit that since the C19 lockdown went into place, thirteen CPG companies signed up with the Hum Network Limited-owned e-tailer, most of which were selling hand sanitizers and disinfectants. Stocking the product themselves, HumMart works directly with CPG companies and refuses to work with retailers. Shah said that companies that joined the platform struggled with the basics – from competitive pricing, crafting images to match each new eCommerce partner, to producing better content.

Bogo

As the leading buy one, get one (Bogo) dealer in Pakistan, the business model at Bogo relies on working with the hotel, restaurant, and cafe (HoReCa) vertical by offering deals to diners. Understandably, due to the C19 and the lockdown that followed, dining out came to a halt as did the value proposition offered by Bogo.

“We have shifted deals to delivery and takeaway and added deals which will create value- insurance, health and hygiene, wellness,” said Tyrone Tellis, Marketing Manager at Bogo. “We have had to adjust our product offering because of the lockdown and restrictions on dine-in. We persuaded restaurants to accept Bogo on delivery and take away [by] adding insurance deals through Smartchoice.pk, a provider of Sanitizers, gloves and masks [from] Surgy.pk, added e-grocers like DKMart, [and] added fumigation services and companies offering sprays for coronavirus and disinfection.”

Tellis said that Bogo’s response to C19 and the lockdown is one of survival, with the business diversifying to work with a range of in-demand vendors and service providers, while monetizing on the lead generation and repeat purchases created. Speaking to Profit, he said that advertising on Facebook has been put on hold in direct correlation to the drop in sales, with the business focusing its resources on enhancing its new delivery and takeaway segment.

Eat Mubarak

Operating in the highly saturated mobile food delivery marketplace space, Eat Mubarak struggled to maintain service levels with its hyperlocal marketplace model, where every restaurant is delivering to its nearby areas, which was a massive challenge during the earlier lockdown days.

“Timings were controlled, the movement between areas was limited which proved to be a significant challenge to overcome,” said Syed Sair Ali, co-founder & CEO of Eat Mubarak. “As restaurants were hit hard by the lock down due to the loss of their dine-in business, many restaurants on a daily basis were thinking of closing down. Some even closed down for a month or two and opened up later. When you are dealing with [over three thousand] restaurants on your platform – where the uncertain environment is making it difficult for your partner businesses to operate – the service levels get affected.”

He said that dine-in centric restaurants were badly impacted by the lockdown, flexible food business models such as quick service restaurants (QSRs) – which Ali says often have better health and hygiene practices – fared well during the strict and relaxed lockdown periods. Speaking to Profit, Ali said that QSRs have a stronger historical focus on the delivery vertical.

“In app engagement and frequency of orders have increased during C19,” said Ali. “We did not engage in massive acquisition due to the challenges in the service delivery. Our existing digital channels continued to play a role in our paid and organic acquisition.

Additional analysis: Taimoor Hassan.

A very in-depth analysis and a worthy reading article. I think these stats were something which everyone looking nowdays in order to get the business strategy play accordingly. Eager to look such an amazing insights from other industries as well. Great work indeed.

A Very detailed and interesting read. Current ecommerce scenarios are excellently summed up in this article. The facts like , Organic traffic Surge, Revenue growth, more and more vendors are interested in Ecommerce, local brands are coming up in E-commerce market more aggresively through market places.

This ecommerce growth is here to stay but we need to be innovative. We have to move from conventional ecommerce. Probably in next article, we can look into innovative initiatives taken from Ecommerce players

We also need to see how can we liverage the platforms which are badly effected due to this COVID period. One of these is the ticketing channel.

As everyone is working from home, so ecommerce is playing a vital role in this situation.

Hi! I really appreciate how beautifully you analyse E-commerce businesses during Covid19. Indeed it was a difficuilt time for all the businesses who are selling sustainability was the biggest challenge for any company.

One to survive during covid19 lockdown, secondly, to retain labour and loyal employees for us it was a biggest challenge we tried to overcome this crucial period of time by jumping into E-commerce store which includes home products as well as healthcare products!

There is always an opportunity in difficult situations too all we need to keep patience and better planning for company and community as a whole

Nice Article….!

Your working style is quite different from others.

I like it.

Find 1,2,3 bedroom Apartments For Sale in Lahore with Aetmaad. We are the leading real estate marketing agency in Lahore Pakistan with a 100% customer satisfaction ratio.