Amidst the flourishing profits of commercial banks, driven by rising interest rates, a narrative of stark inequality emerges, leaving private businesses and individuals struggling with the tightening grip of limited borrowing opportunities.

Interest rates in Pakistan soared to an all-high level of 22% on June 27, 2023, as the government scrambled to make last-minute changes to secure a deal with the International Monetary Fund (IMF). Since then, the policy rate has remained at an elevated level.

In a previous conversation with Profit, Mustafa Pasha, chief investment officer at Lakson Investment Limited bemoaned the waning enthusiasm of banks to extend credit to private enterprises. “Private-sector borrowing costs have gone up due to high interest rates. Financing availability from banks has been reduced because banks are less willing to lend to the private sector and prefer lending to the government. Demand and supply for financing have gone down, squeezing private-sector credit. This also means that greenfield projects and new investments have decreased while working capital requirements have increased.”

While analysts anticipate rate cuts in the coming monetary policy meetings, an elevated inflation rate remains a challenge. The country has been fighting a losing battle with inflation, leading to the State Bank of Pakistan (SBP) maintaining interest rates at unsustainable levels. One of the conditions set by the IMF is to maintain a tight monetary policy to bring down inflation which means that a rate cut will only be possible if the inflation rate falls below the prevailing interest rate.

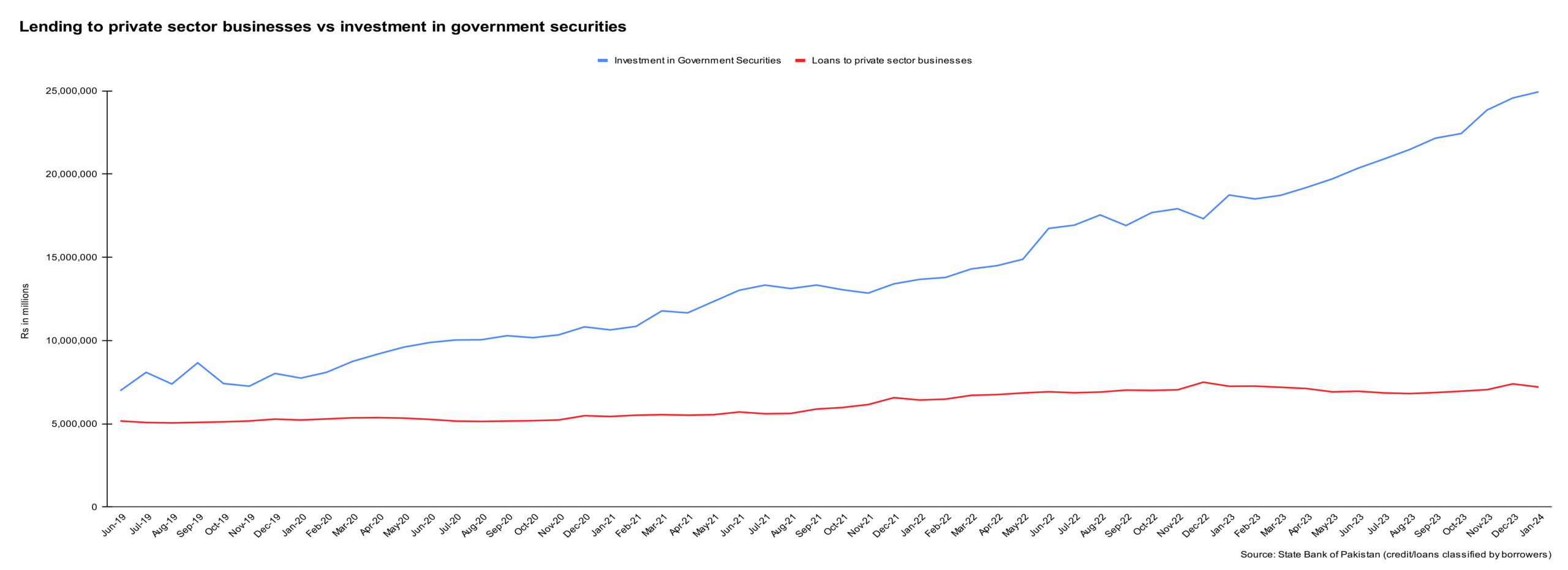

Given the persistently high interest rates with no sign of reprieve, commercial banks continue prioritising investment in secure government securities, over riskier private sector. At the end of December 2023, investment to deposit ratio stood at 91%. This means that the majority of the deposits with the banking sector are being lent to the government, resulting in crowding out of the private-sector.

To explain the underlying trend in private credit, Profit reached out to Navid Goraya, Chief Investment Officer at Karandaaz Capital, a vehicle of Karandaaz Pakistan that promotes access to finance for micro, small and medium-sized businesses (SMEs). “Banks have become more cautious in lending to the private sector to avoid asset quality deterioration and have instead channelled available liquidity to government securities. Investment in government securities increased by 42% during 2023 to Rs 24.5 trillion,” explained Goraya.

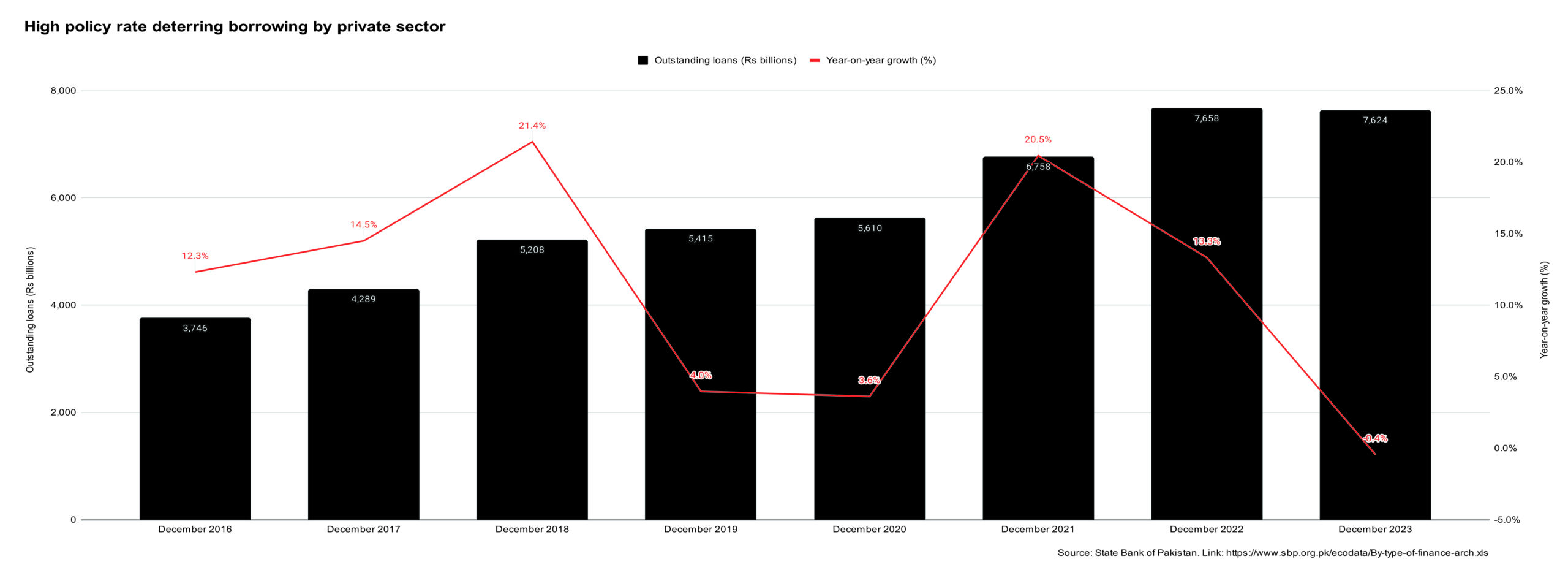

He attributed the squeezing out of private sector financing to a high policy rate. “In almost over a decade, we have first-time witnessed a decline in advances to the private sector which fell by 0.4% year-on-year in 2023. Historically, there has usually been a double-digit growth in advances to the private sector.”

He attributed the squeezing out of private sector financing to a high policy rate. “In almost over a decade, we have first-time witnessed a decline in advances to the private sector which fell by 0.4% year-on-year in 2023. Historically, there has usually been a double-digit growth in advances to the private sector.”

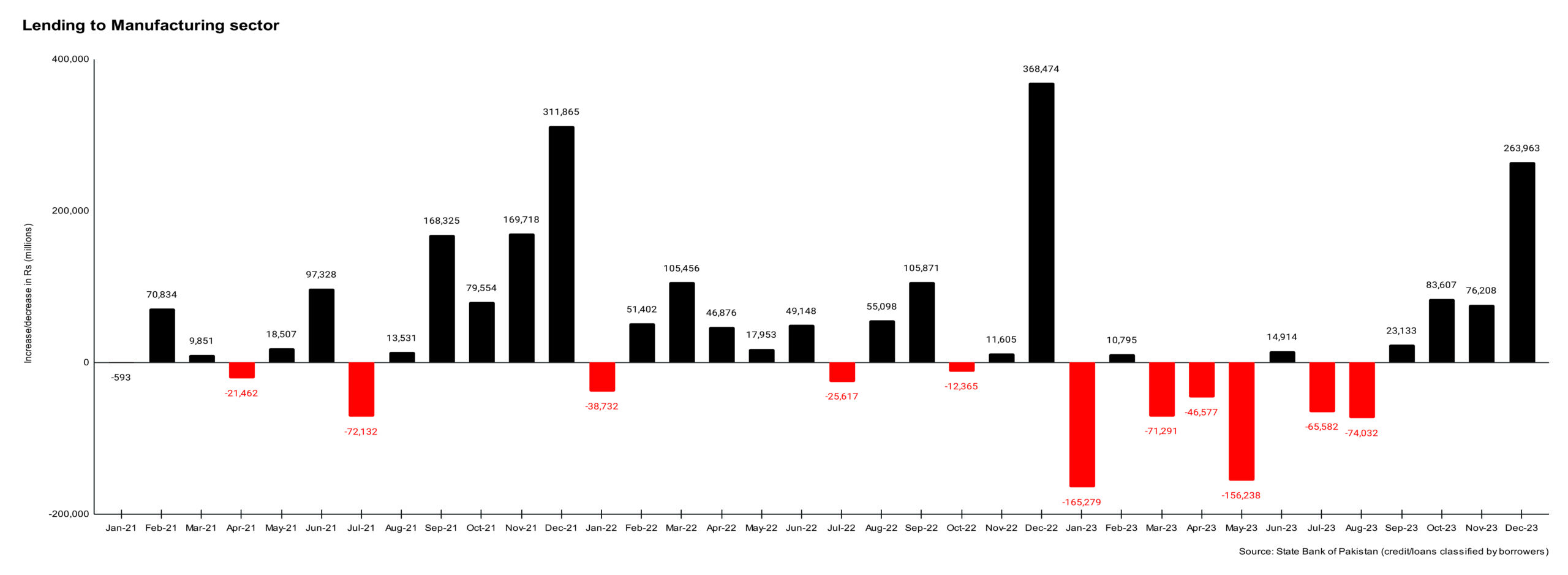

Within private sector lending, the manufacturing sector accounts for around 65-66% of total loans. Lending to the manufacturing sector declined by Rs 106 billion from Rs 4,955 billion in December 2022 to Rs 4,848 billion in December 2023. As the following chart shows, lending to the manufacturing sector declined for much of 2023, only picking up pace in the last quarter of 2023.

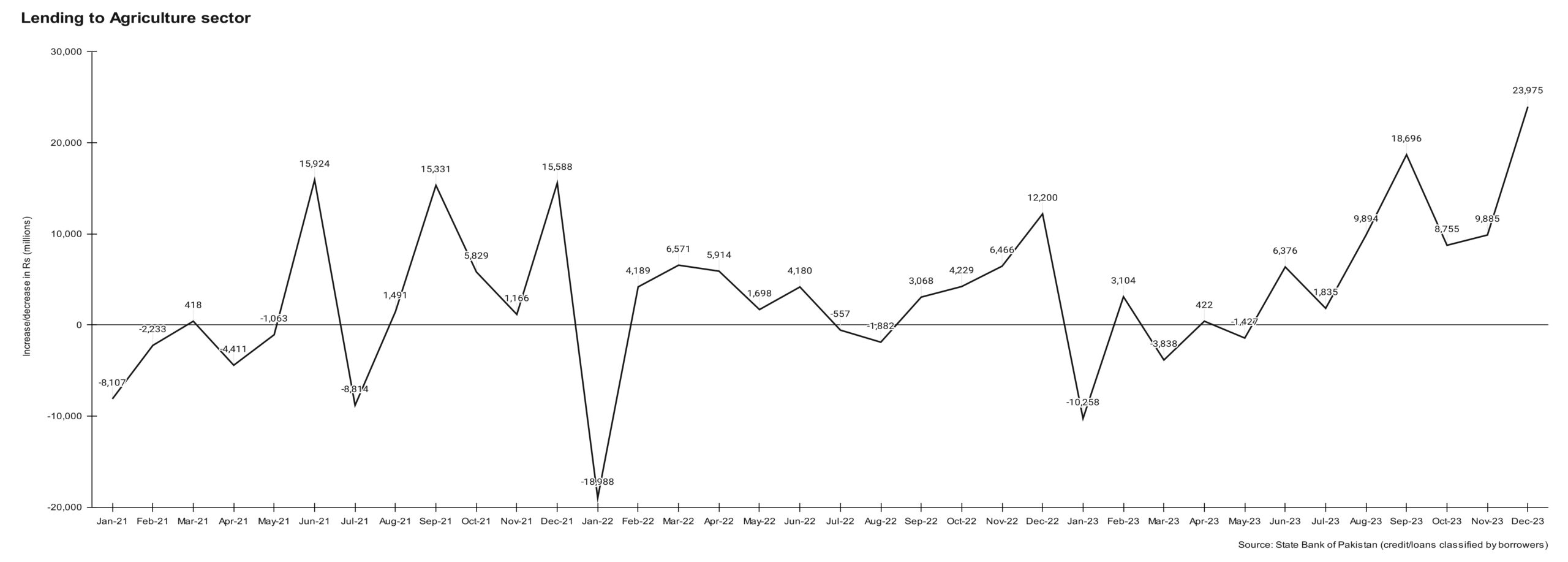

On the other hand, lending to the agriculture sector, which accounts for 6% of total lending to the private sector, increased in the second half of 2023. Overall, lending to agriculture increased by 19% from around Rs 350 billion to Rs 417 billion.

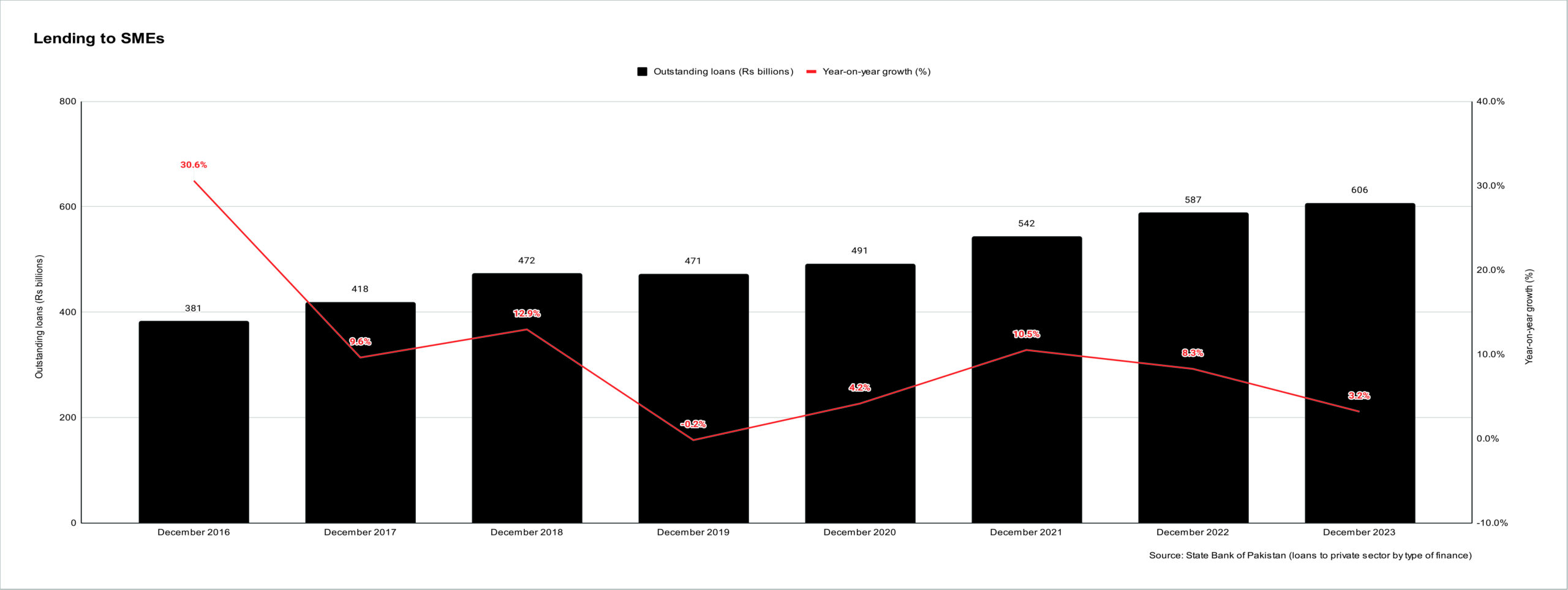

Loans to SMEs grew nominally by 3% from Rs 587 billion in December 2022 to Rs 606 billion in December 2023. Goraya voiced apprehensions regarding the impact of elevated interest rates on SMEs, noting, “We are seeing stress across the SMEs as they are more sensitive to high-interest rates. Businesses are trying to grapple with the increased borrowing costs and many SMEs are using own-source funds to settle their commercially priced loans.”

At the same time, he advocated for increasing lending to SMEs. “While the subsidised SME Asaan Finance (SAAF) Scheme has cushioned SME lending, the overall size of the pie is still substantially low given there are more than 5 million SMEs in Pakistan”. Goraya added that lending to SMEs accounts for less than 8% of overall private sector advances whereas their GDP contribution is around 40%.

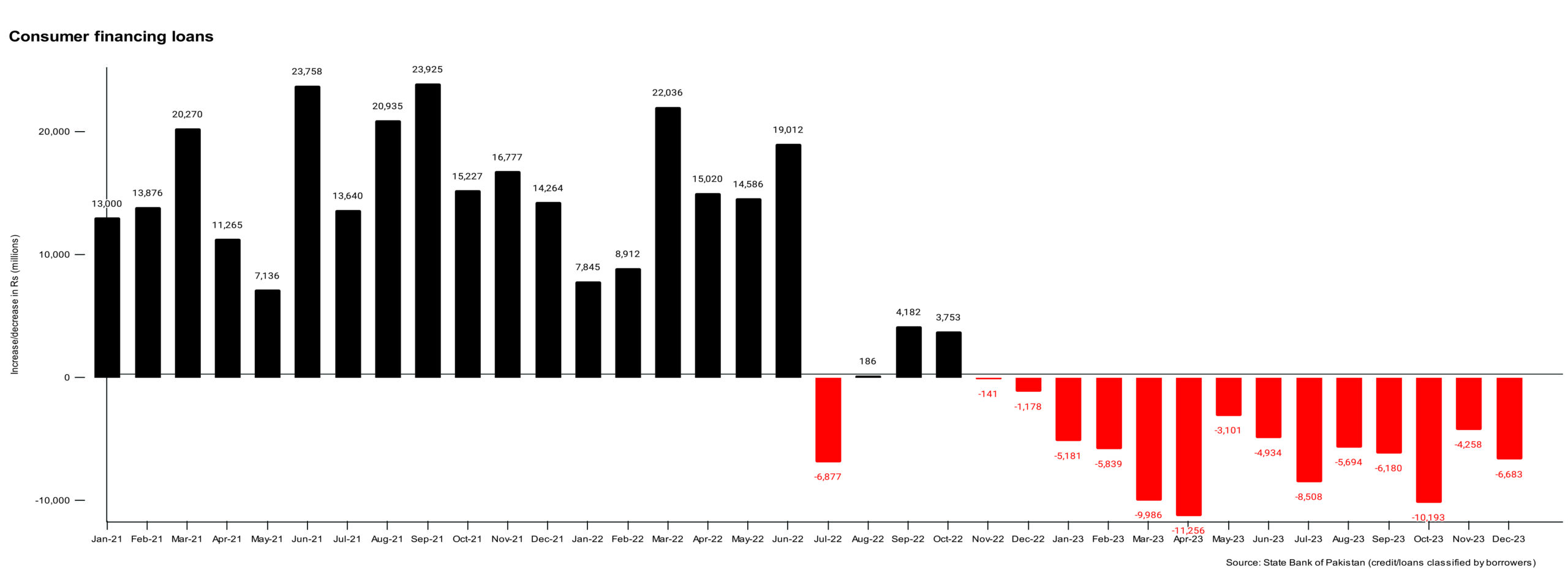

Much like private sector businesses, borrowing by individuals has also plummeted. Personal borrowing declined by Rs 22 billion in 2023 from Rs 1,143 billion in December 2022 to Rs 1,120 in December 2023. However, lending to bank employees has risen by around Rs 60 billion. On the other hand, consumer financing decreased by 9% year on year from Rs 900 billion in December 2022 to Rs 818 billion in December 2023.

In January 2024, consumer financing declined by another Rs 4.3 billion. While the overall trend in consumer financing loans is on a downward trajectory, there is a contrasting surge in credit card usage. This increase in credit card usage could potentially be attributed to the inflationary pressures prompting individuals to rely on credit cards to finance their purchases.

The prohibitive costs of borrowing have dissuaded the private sector from seeking funding for investment and expansion endeavours. “The IMF also recently downgraded Pakistan’s GDP growth estimate for fiscal year 2024 to 2% from October’s estimate of 2.5%,” warned Goraya. However, Pakistan is at an economic crossroads. While a rate cut would make borrowing affordable for the private sector, a premature rate cut could lead to higher consumption and thus inflation.

Recent signals from the T-bill auction on February 21 indicate a potential delay in the interest rate cut cycle. In the T-bill auction that happened on February 21, market participation in three-month T-bills was the highest with bids worth Rs 649 billion received, exceeding the 12-month paper for the first time in four months.

The three-month treasury bill yield bumped up by 126 basis points reaching 20.6998%. Similarly, the yield on the 12-month paper increased by 25 basis points to 20.33% while the yield on 6-month t-bills remained unchanged. “We witnessed major investor participation in the 3-month T-bill auction, most likely driven by expectations of a possible delay in the interest rate cut cycle, contrary to the previous market anticipation of such a cut in the March 2024 policy,” explained Sana Tawfik, deputy read of research at Arif Habib Limited in a note.

Analysts believe that higher inflation expectations in near future, political uncertainty, along with the upcoming last review of the stand-by arrangement (SBA) with the IMF, scheduled for March 2024, are the reasons behind the change in rate cut expectations. Hence, even though a rate cut is desired by the private sector, its timing and magnitude hinge on inflation’s trajectory.

In my understanding most of the monetary policy interests rates are aimed at inflation targeting. The high inflation is a serious concern. However, increasing the monetary policy interest rates is not enough, unless the underlying causes of high inflation is not properly addressed.

Its really an admirable article.