OICCI hails Shabbar Zaidi’s appointment as FBR chairman

Foreign investors' body says it looks forward to a major change in taxation structure under Zaidi's tenure

KARACHI: The Overseas Investors Chamber of...

Govt approves amnesty scheme

Hafeez Shaikh says 'basic purpose' of scheme is to document economy, make dead assets functional

4pc will be charged for whitened...

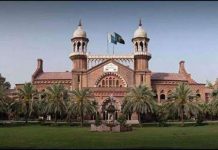

LHC summons FBR officials to explain hike in POL prices

LAHORE: The Lahore High Court (LHC) on Tuesday took up a petition challenging the recent hike in the prices of petroleum products.

Justice Shahid...

FBR chief says harassment of taxpayers won’t be allowed

ISLAMABAD: Federal Board of Revenue (FBR) Chairman Shabbar Zaidi said on Tuesday that there would be no raid or harassment of the taxpayers,...

CPG lauds appointment of Shabbar Zaidi as FBR chairman

The Corporate Pakistan Group (CPG) has welcomed the appointment of Syed Muhammad Shabbar Zaidi as the Chairman Federal Board of Revenue (FBR)...

FBR forms directorate to eradicate money laundering

ISLAMABAD: The Federal Board of Revenue has formed a directorate to curb money laundering, according to a notification issued by the top revenue...

Govt urged to clear the air surrounding Shabbar Zaidi’s appointment

ISLAMABAD: Islamabad Chamber of Commerce and Industry (ICCI) on Wednesday urged the government to take strong measures to reduce tax gap in order...

‘Nominated’ FBR chairman vows to repose people’s trust in taxation system

The prime minister-nominated chairman of Federal Board of Revenue (FBR) Shabbar Zaidi has said that the people had lost trust in the...

Pakistan needs to enhance tax compliance instead of hiking tax rates: WB

Pakistan does not need to impose new taxes or hike tax rates because the existing taxes have potential to achieve taxation targets,...

Shabbar Zaidi appointed as FBR chairman

Prime Minister Imran Khan on Monday announced that the government has appointed renowned economist and tax affairs expert Syed Shabbar Zaidi as...

FBR recommends three phases for new amnesty scheme

ISLAMABAD: The Federal Board of Revenue (FBR) has recommended three phases for the new tax amnesty scheme for undeclared assets.

According to a tax...

LHC sets aside FBR’s suo motu powers to collect sales tax

'FBR cannot collect sales tax from any businessperson without registering him/her'

LAHORE: The Lahore High Court (LHC) has set aside the suo moto...

National exchequer bears the brunt of flawed tobacco taxation policies

ISLAMABAD: The national exchequer has incurred a loss of approximately Rs153 billion in terms of revenue collection during 2016-2019, owing to the introduction...

FBR informs World Bank about recent tax reforms

ISLAMABAD: A meeting was held between the representatives of the Federal Board of Revenue (FBR) and World Bank on the tax reforms introduced...

‘Tax-evading tobacco companies only paid Rs1.5bn in FY18’

ISLAMABAD: The tax-evading tobacco companies have just paid two per cent in taxes (Rs1.5 billion) in the fiscal year 2017-18.

This was stated by...