Pakistan faces $1.7 billion trade deficit with Iran under barter system

Committee also seeks identification of those responsible for sugar crisis; timber import dispute resurfaces

Pakistan posts $110m current account surplus in September on higher remittances

First-quarter deficit widens to $594m despite monthly improvement, SBP data shows

Fuel prices set to rise Rs3 per litre as Sindh reimposes 1.8% cess on petroleum imports

OCAC warn of nationwide supply disruption as PSO, Hascol, and PGL cargoes face clearance delays at Karachi port

SBP partners with World Bank’s IFC to expand local currency financing in Pakistan

Agreement aims to manage currency risks and boost IFC’s rupee-based investments to support private sector growth

CDWP approves Rs35.4 billion development projects, including key ML-1 railway upgrades

Uplift projects worth Rs280 billion referred to ECNEC for final approval

FBR identifies over 20 tax evasion cases through lifestyle monitoring drive: report

Over Rs800 million in hidden assets, luxury vehicles worth millions, and foreign trips uncovered among individuals declaring minimal income

Federal govt approves wheat policy 2025–26, fixes support price at Rs3,500 per 40kg

6.2 million tons to be procured for national reserves; restrictions on inter-provincial movement of wheat lifted

Audit uncovers Rs35 million illegal payments in PEIRA

ISLAMABAD: A startling financial scandal has hit the Private Educational Institutions Regulatory Authority (PEIRA) after an official audit revealed that its chairperson...

Pakistan to auction 800MW power in November under new competitive market system: report

First-ever Competitive Trading Bilateral Contract Market auction to open electricity trade to private suppliers; winning bidders to be announced by January 2026

SBP expected to maintain policy rate at 11% amid rising inflation

Arif Habib Limited projects FY26 inflation to average slightly above 7%, beyond SBP’s target range

Pak-Qatar Family Takaful plans Rs1.1 billion IPO amid PSX rally: report

Shariah-compliant insurer to offer 50 million shares at up to Rs21 each next month

Government waives August electricity bills for flood-affected consumers

Decision applies to domestic users; commercial bills deferred for four months with six instalment option

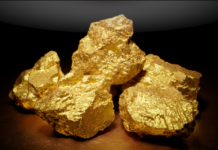

Pakistan’s gold holdings surge to $9 billion as global bullion prices rally in 2025

Gold now accounts for two-thirds of Pakistan’s liquid reserves; domestic prices also hit record highs

IMF proposes technical mission to probe $30 billion trade data discrepancy, Pakistan declines offer: report

Authorities link gap to unrecorded imports under facilitation schemes; IMF urges data reconciliation and transparency

Sindh govt demands bank guarantees on oil imports from petroleum companies

Enforcing bank guarantees for every shipment could create major liquidity and operational problems for importers and refineries, warns oil industry