With lasting expected effects on consumption, business models and marketing expenditure, Covid-19 and the lockdowns that followed have impacted supply, demand, and media consumption. Vincent Létang, EVP of global market intelligence at Magna, said that the current situation is totally unprecedented, with the closest historical equivalent being a combination of the great recession and 9/11. Profit spoke to seven marketing leaders in the fast moving consumer packaged goods (CPG) space to understand how businesses adapted to the interruption to value chains and ecosystems.

This article concerns seven companies that fall under the CPG category due to the majority of their product portfolio. Four of the companies Profit spoke are foriegn owned, while three are local. While all seven companies do not in every instance compete with each other, they do share consistencies in appealing to home and personal care, consumer healthcare, hygiene, and the skin care share of our wallets. Our reporting here includes surveys and interviews we have conducted with key people at these companies, or people who are familiar with the operations of these companies.

What we have found are three key trends across the sector as a whole that help illuminate the brave new world companies in this sector find themselves operating in.

Key Findings

- The fastest path to eCommerce is (apparently) with an online marketplace

The lion’s share of respondents to this study rely on marketplaces and e-tailers to sell products online for them, forgoing the benefits of owning a platform and acquiring first party data. Brand marketers that spoke to Profit insisted that an owned, branded site was in the works, with delays being attributed to sorting out delivery, storage, and fulfillment partnerships. In relying on third parties even just for now, the CPG firms faced the wrath of customers when deliveries were delayed, when prices were inaccurate, and when the quality product cataloguing did not reflect the true appearance of a product.

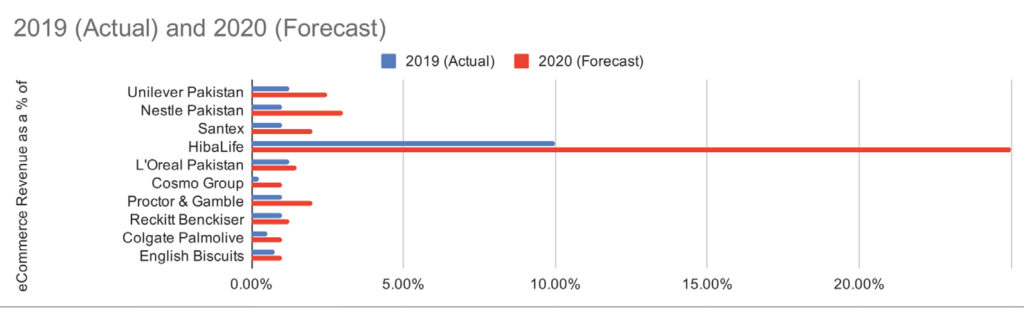

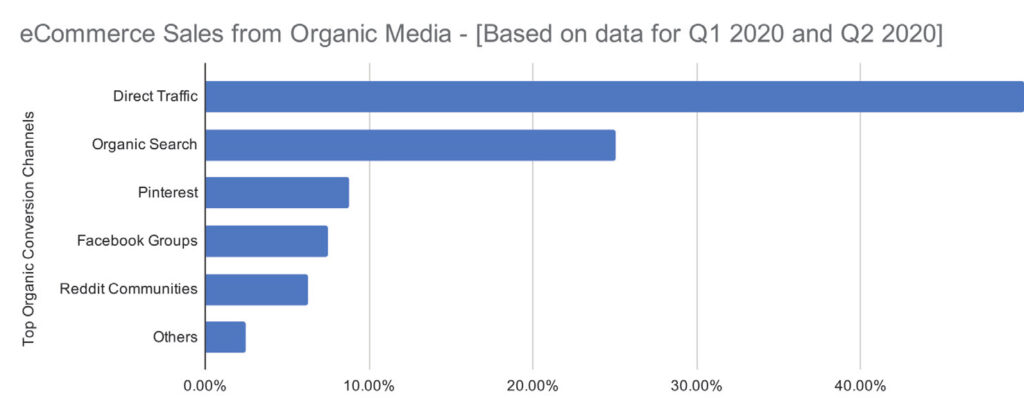

Respondents that were more digital savvy divulged that a business case has been made to partner with Brandverse, an eCommerce solution that uses uses robotic cameras to catalogue products from a variety of angles and uploads the digital images (and brand approved content) on the Flare app, which is a means of selling and distributing the products as well. The attached bar charts illustrate how nearly every CPG company has double sales through the eCommerce revenue stream. As stated in the Profit apparel study, an increased percentage of spending online does not mean that like for like (LFL) nominal revenue has also increased. This means that same-store sales revenue has gone down overall, even in absolute numbers, according to most respondents.

- Buying behavior – quantity and frequency – shifted out of uncertainty

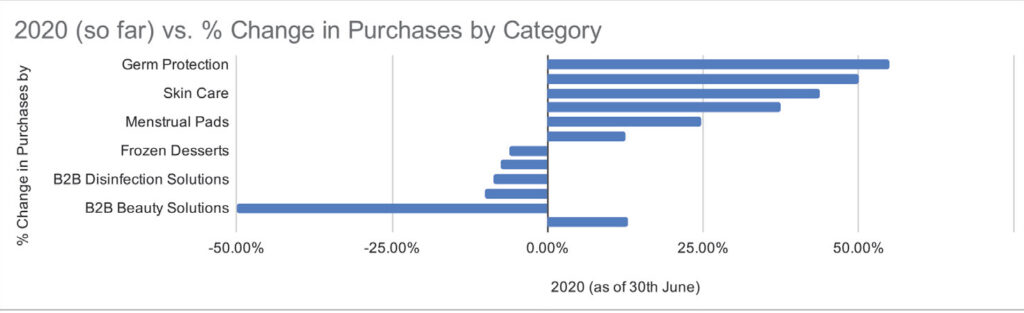

Respondents shared how purchasing behaviour shifted across categories, with many buyers stacking their shopping carts higher than usual with Covid-19 essentials, menstrual pads, skin care, hair care, contraceptives, and soup mixes. The experts that spoke to Profit said that qualitative surveys at the point of purchase revealed that buyers were afraid that there would be longer and more restrictive future lockdowns given the news of exponential rise in Cocid-19 cases. They were thus planning for the worst case scenario.

Speaking to Profit, business intelligence and market leaders insisted that the spike in purchases had more to do with being a prudent measure instead of being indicative of the frequency of product usage. The only exception to this was for C19 essentials, such as germ protection soap, which went from being used thrice a day before Covid-19 to several times a day.

Echoing the apparel study by Profit, sources shared that the double digit sales through eCommerce had more to do with shoppers being either unwilling to risk exposure at brick-and-mortar stores, or that many had no choice in the matter. Profit’s survey data shows that shoppers substituted in-store purchases with online purchases.

- “I’m the captain now” meets “All your bases belong to us”.

Respondents that rely on third party marketplaces, e-tailers, and courier services complained that the companies were taking advantage of the situation with higher margins and win-lose terms of service. Many complained about not being able to work with marketplaces on a trading model, whereby an upfront amount is shared, which goes against the marketplace model which shares revenue as a product is sold.

Either through a fundamental misunderstanding of the marketplace business model or due to a top-down instruction to get the best possible deal for the least possible effort, respondents were upset that marketplaces and e-tailers refused to hand over first party data or offer free visibility on the product home page (mobile app or web app), of which the former is mentioned as the intangible property of the vendor while the latter is part of the advertising business model.

CASE STUDIES

According to Profit’s analysis of Household Integrated Economic Survey (HIES) and Pakistan Social and Living Standards Measurement (PSLM) data from the Pakistan Bureau of Statistics (PBS), consumer spending on groceries was approximately Rs6,540 billion ($48 billion) in Pakistan, which makes up approximately 38.5pc of total consumer spending. An analysis of Pakistan’s supply chain capabilities by Profit found the country has approximately 650,000 to 700,000 kiryana stores and that no CPG company is able to distribute products to all of them.

To understand the impact of the pandemic on the CPG industry, Profit spoke with business intelligence leaders at seven companies, four of which are foriegn owned multinationals and three of which are locally owned manufacturers and distributors. All of them rely on international modern trade (IMT) and local modern trade (LMT) for over 90pc of total revenues, with experiments in eCommerce either with third party online marketplaces or with owned sites, with respondents predominantly falling into the former category.

Santex

As a manufacturer of feminine hygiene products, Santex first began selling its products on Daraz two years ago. Towards the end of 2019, the company created its own eCommerce website to acquire first party data, own retargeting, and the insights gathered. The company was driven by a desire to own the direct link to product buyers and product users, given the sensitivity of the product inquiry level.

“Periods do not stop for a woman irrespective of whether there is a pandemic or not,” said Dione Rodrigues-Almeida, the Marketing Manager on Brand, Innovation, eCommerce & Outreach Programs at Santex. “So it was critical we get our sanitary range to consumers via both B2C and D2C channels.”

Speaking to Profit, Rodrigues-Almeida said that, like most CPG companies, Santex had a tough time at the start of lockdown due to the improper labeling between essentials and nonessentials by the government, which was resolved after weeks of lobbying.

“During the initial Karachi lockdown in April, the biggest challenge was moving stock to consumers from our factory due to movement restrictions,” she said. “Another challenge was rules regarding eCommerce deliveries and what products were essential to deliver. It took about two to three weeks for some amount of normalcy to come back after which orders for D2C were resumed albeit shorter delivery time within a day.”

She said that an owned website proved to be the best alternative sales channel during the initial lockdown crisis. This in turn resulted in the consumer base expanding and the company was now able to increase new users, who previously would never purchase online. During April 2020, when the pandemic was beginning to peak, due to the nature of the product, women started bulk buying most SKUs. Rodrigues-Almeida shared that the company saw an organic increase in orders like never before, and had to increase forecasts for online orders.

Butterfly, the flagship feminine hygiene product by Santex, introduced bulk slab discounts in May 2020 for SKUs in order to provide a discount option for consumers as well. Rodrigues-Almeida told Profit that since May, Santex has been very active in D2C marketing to consistently inform consumers, as an essential brand, that the products are available for safe, direct, deliveries to their homes.

“This has worked for the overall online sales and has shown a positive upward trend,” she said. “Covid-19 has also given rise to existing e-retailers expanding their portfolios, or new ones trying out this direction. Since mid-April, we have either onboarded or are in talks with many such e-retailers to expand our reach online, so that the consumer may find us across the board in all major options available to her. So overall, for D2C, for a brand like Butterfly, we have increased consumer reach and orders via our existing channels. Tried to make our online propositions more relevant to what the consumer wants during this period of time.”

She added that despite the success of the owned eCommerce site, the company continues to partner with e-tailers in order to leave no stone unturned. On that note, the company developed an outreach program for underprivileged societies and schools in order to educate them on menstrual hygiene management.

“During the pandemic, we were unable to go the route of education but adapted our vision to the relevant need of the time,” she said. “Santex collaborated with quite a few NGOs, schools, and hospitals and supplied free sanitary napkins to help these organizations ration drives for the needy. We were able to help serve 6000 + periods in Karachi alone in April.”

English Biscuits Manufacturers

Previously known as Peek Freans Pakistan, English Biscuit Manufacturers (EBM) considers itself to be a market leader in the biscuits category with a sales distribution network that covers over two hundred thousand direct distributors.

“For our products to reach both across Pakistan and internationally, we are targeting 100pc of the IMT and LMT trade channels,” said Rais ur Rehman, senior manager of trade marketing at EBM. “[Our] brand portfolio is mostly driven by consumers who have been buying our products for decades now. It is our uniqueness as a brand and the credibility of our products that generates revenues for us. In 2019, more than 99pc contribution of sales was driven by the offline channel, whereas less than 1pc contribution was marked by eCommerce.”

Rehman insists that EBM has been actively establishing an eCommerce channel since before Covid-19, and that the company had realized the potential of the customer acquisition medium after learning from global market practices. He said that the biscuits manufacturer generated under 1pc of total revenues using eCommerce, and expects that in 2020 the method will yield a slightly higher return.

“The discount and pricing regimes have to be carefully monitored now, as no one can afford to distort existing market channels and framework in lieu of a newly emerging channel – such as eCommerce,” he said. “From what can be observed, eCommerce appears to be a lot more active concerning certain industries, such as textiles and electronics. Though there has been a definite increase in the activity generated by this channel, and it has also exponentially increased potential, which still needs to be captured.”

Rehman said that the CPG industry as a whole relies heavily on brick-and-mortar stores, whether in the form of giant IMT, LMT, or the neighborhood kiryana stores. In light of this, he does not believe that eCommerce will scale to the potential observed intentionally, adding that there is an exponential growth in the local context, as a lot of brick and mortar stores are also engaging in opening their eCommerce platforms in accordance with their physical presence.

HibaLife

With a network in excess of 100 local modern trade (LMT) relationships and nearly two thousand general trade shops nationwide, HibaLife reigned in 90pc of its 2019 revenue from offline paths of purchase, with the remainder 10pc of 2019 revenue coming from eCommerce paths of purchase. Within days of the C19 lockdown, the herbal medicines business switched its attention to generating sales through eCommerce, while increasing its presence on the Google Display Network. Faizan Syed, CEO of HibaLife, told Profit that this decision yielded the best results in April 2020.

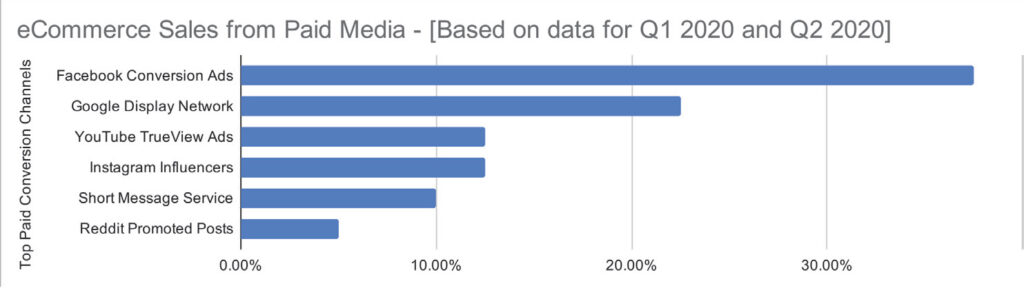

“The TV ad budget was shifted entirely to digital,” he said. “Digital allows for accurate tracking of every dollar spent, whereas on conventional ad spend, 70pc of advertising is wasted and cannot be tracked back to the consumer level,” he said. “Our main focus was previously brand promoters at the point of sale where the consumer had the first interaction with the brand. However, given the movement restrictions during Covid-19, this wasn’t possible, so the spend was closed and shifted to digital.”

Syed told Profit that sales from eCommerce were growing at a steady pace, with the current trajectory suggesting that between 25pc to 30pc of total revenue will be derived from online customer acquisition efforts. Mirroring responses across this CPG study and a recent B2C apparel study, HibaLife faced challenges on the supply chain front, with enterprise resource planning ensuring timely dispatches and in managing out of stock situations. He added that quality assurance with courier services was a challenge, with brand integrity impacted when products reach buyers in terrible condition.

Unilever

Within a month of reporting a 11.7pc growth in sales to $78.8 million during the year ended 2019, Unilever Pakistan was shaken by the strict lockdown measures imposed by the Government of Pakistan in response to the rapid spread of COVID-19. The severe disruption to the global socio-economic environment meant that effects on supply, demand, and media consumption have been more complex than in any normal economic recession in the past, and some of them will outlast the current crisis, according to Létang.

“Towards the end of the last quarter, the Government of Pakistan ordered a strict lock down which adversely impacted the industrial & commercial activities with ensuing hardship on the general public,” said Aman Ghanchi, Executive Director Legal & Company Secretary at Unilever Pakistan, in a letter to the General Manager of the Pakistan Stock Exchange Limited. “Despite the abnormal conditions, your company performance in the last quarter was very encouraging.”

In his letter, Ghanci revealed that sales at Unilever Foods Pakistan Limited grew by 17.2pc on the back of strong brand equity, successful innovations and sustained investment in advertising and promotion, while gross margins declined by 2.64pc to 40.8pc due to the difficult operating environment. He added that the earnings per share (EPS) increased by 48.4pc versus the same period last year. Since then, Unilever has to restructure its resource pool within the context of omnichannel, pure players, and Dark Stores as alternative paths to reaching customers, according to sources familiar with the matter.

“On the omnichannel front, Unilever Pakistan is working on a 3P fulfillment model, such as that of Naheed Supermarket and Metro Cash & Carry,” the sources said. “We also work with pure players such as GrocerApp, Bagallery, and HumMart, with the e-tailers having their own warehouses in which they self-stock inventory.”

Leopard Courier, the courier partner for Unilever Pakistan, manages deliveries while the front end is managed by Careem and Cheetay. Before the lockdown, Foodpanda had already initiated its own Dark Store initiative and secured a deal with Brandverse, a rapid eCommerce go-to-market solution, to launch Pandamart. In doing so, Foodpanda is able access the largest catalogue of products in the country, with hi-res images and content, along with a whitelabel eCommerce site that is ready to be discovered and ordered from. The sources told Profit that the drop shipping model with Pandamart and Careem has led to booming sales.

Sources shared with Profit that while Hindustan Unilever and the NAME (North Africa, Middle East) regional teams have their own direct to consumer (D2C) channels, Unilever Pakistan as a whole does not. The business does have D2C platforms in Pakistan for specific products such as over 5,000 bicyclists for Wall’s, the Magnum Store as standalone outlets or within major malls, and more recently Munchies, a snack ordering app that was in the planning phase since mid 2018 and was sped out by VentureDive before the lockdown.

They further revealed that the decision to ramp up Munchies may have had something to do with how badly the business to business (B2B) Food Solutions division and portfolios for out of home and frozen desserts portfolio have been hit due to Covid-19. The homecare category – comprising Surf, Domex, Vim – and the personal care category – comprising Lifebuoy and Lux – have seen Covid-19 as a blessing in disguise, as sales exceed the best case scenario laid out by demand planning teams.

The eCommerce department at Unilever is led by Imad Paracha, and was the only department to not only increase its headcount after the lockdown, but also saw an increase in its secondary targets. Naturally, they were also the only department to receive further investment instead of budget cuts. Research from Afterpay suggests that the boom in eCommerce sales around food & groceries has more to do with avoiding people in crowded stores than it does with convenience, pricing, and store operating hours.

According to people familiar with the matter, Unilever receives engagement requests from new pure players everyday, with little understanding of the financial muscle for a long term relationship. Another challenge faced by the department is the reluctance of existing and new players in working with cash, while Unilever itself has become extremely stringent about working with credit. Perhaps the biggest challenge shared by not just these sources but other CPG employees Profit spoke to, is the reluctance of e-tailers – such as HumMart – to share the purchaser profile. Liaisons of eCommerce teams at Nestle, P&G, and Colgate Palmolive claimed that pure players are hesitant to share data on who is the buyer, what did they come looking for, which traffic source did they come from, and what time of the day is conversion traffic the highest.

“They literally hold back that information even though they know that information will help us build better, more relevant content,” a relevant source tells Profit. “[They tell us that] ‘our bosses don’t allow us to give that information out’, so we then resort to A/B testing different content on different platforms at different times, to see where we’re getting more conversions from.”

The sources at Unilever credited Mindshare Pakistan as the backbone of eCommerce media campaign execution, while its parent company has announced a wave of new digital oriented openings in the Karachi office. While the media agency has been a Unilever partner for decades, the relationship was strengthened through the introduction of Ultra in 2016, a Unilever trading desk for programmatic advertising. According to Keith Weed, former Chief Marketing and Communications Officer at Unilever, Ultra delivers hyper targeting at scale and is the first trading desk transacting on 100pc viewability.

As part of its data-driven, long-term digital eCommerce roadmap for Unilever Pakistan, Mindshare Pakistan is working with online retailers – such as open markets, social commerce, general malls – to seek new media opportunities. To date, the eCommerce function at Unilever Pakistan has grown four times over the last year to date, averaging double growth from omnichannel partners and seven times growth with pure players. The team went from operating in two cities before the Covid-19 lockdown to having a presence in nearly 15 cities by May 2020.

Like most businesses operating in the eCommerce space, Unilever Pakistan is faced with outstanding payments issues and stuck end stocks. This happened due to numerous online retailers speculating that Unilever Pakistan would not be able to keep up with production and supplies for items such as hand sanitizers, soaps, tea, hand washes, surface cleaners. However, Unilever responded by stocking up in bulk. This perceived inability to match demand with supply was not the case, the sources added, with Unilever resolving its numerous challenges with flash sale budgets or stock swaps.

“Unilever refused to give these e-tailers any unnecessary TTS on these Covid-19 relevant items throughout the lockdown period, because of which they couldn’t liquidate the amount of stock they had piled up,” the sources shared.

The British-Dutch multinational consumer goods company utilizes People Data Centres (PDC) across five key markets, which provide real time insights to people related questions through the combination of live data sources. It also taps into data provided by six digital companies it has invested in, namely Brandtone, Big Sync Music, Clavis, Olapic, Percolate, and Discuss.io.

With these investments, Unilever global is able to empower its eCommerce teams worldwide with the ability to execute mobile database marketing in emerging markets, gain music licensings for ads, gain eCommerce retail measurement, access to UGC, cross-platform CMS, and access quick & low cost research. At industry events, Weed has claimed that these investments have given the company data driven customisation, which uses consumer search queries to predict trends and match content with a real time purchase opportunity.

Nestle

Reeling from the impact of Afghanistan border closure on exports, Nestle Pakistan managed to achieve a 2.6pc like for like (LFL) rise in revenue for the first quarter of 2020. Within a week of the Covid-19 lockdown, the Swiss multinational food and drink processing conglomerate corporation committed PKR 100 million as pledge for underprivileged societies and frontline workers, in the form of products and cash donations. On the latter, the company shared that hand hygiene stations would be installed at public places, quarantine zones, and health facilities across Balochistan and Khyber Pakhtunkhwa.

On the business front, Nestle Pakistan had invested the better part of 2019 working with Daraz for its eCommerce operations, pushing its products using Facebook Collaborative Ads. The results can be seen in a report from Daraz, ranking Nestle Everyday and Nestle Nido in the top ten CPG products sold on the Alibaba Group owned online marketplace and logistics company. After the lockdown went into effect, key decision makers in the Nestle Pakistan eCommerce team opted to remove all their eggs from the Daraz basket and onboard additional marketplace vendors such as MyVitaminStore.pk, Dawaai.pk, GrocerApp, HumMart, and Metro Online.

“Prior to COVID 19, Daraz and other e-retailers were not willing to handle perishable liquid items like juices and milk but now they are selling juice, ready to drink (RTD) coffee and RTD chocolate and malt powder products,” sources shared. “In terms of media spend, major contribution to eCommerce, [our spending] came from the reallocation of some of online upper funnel spend/activities.”

Sourced shared that in 2019, only 1pc of the total sales at Nestle Pakistan came from eCommerce channels, which amounts to PKR 1.16 billion ($7.5 million in December 2019) according to the 2019 earnings report. Sources shared that based on the current trajectory, eCommerce will bring in between 2pc and 3pc of total revenue in 2020.

Since the Covid-19 lockdown, the company has doubled its spending on eCommerce and lower funnel campaigns during the second quarter of 2020, resulting in eCommerce sales rising by 50pc and offering 50 times the average return on ad spend (ROAS). In terms of customer acquisition, sources shared that the ROAS of 50:1 is being achieved by using a combination of Facebook Conversion Ads, Paid Search, YouTube Trueview Ads, organic search, and display ads.

“The overall structure of any CPG [industry] in Pakistan [has a] heavy reliance on offline sales & revenue and that’s the main bottleneck,” sources said. “Categories such as coffee, waters, beverages, and juices have declined, while infant nutrition and powdered dairy categories have grown.”

Reckitt Benckiser

With over 150 thousand point of sale touch points – directly and indirectly – across Pakistan, Reckitt Benckiser splits its business between its traditional consumer goods and its consumer healthcare portfolio. For the former, LMT and IMT are engaged, along with the neighborhood kiryana stores. For the latter, the British multinational consumer goods company is covered by over 30 thousand pharmacies operating under its consumer healthcare distribution network. Kashan Hasan, CEO of Reckitt Benckiser Pakistan Limited (RBPL), spoke to Profit about how the leading a producer of health, hygiene and home products reacted to the C19.

“The response has been super fast, anticipating the exponential growth in the e-commerce channel and prioritizing stocks for online channels and adding more resources to expedite execution,” he said. “We increased performance marketing spends as well. Challenges in terms of supply constraints were faced, where demand grew faster than supply in the case of liquid handwash, sanitizers, antiseptic disinfectant liquid, [and in some cases] Durex & Veet as well.”

Across all product categories, Hasan said that the eCommerce team was given first priority for stock allocation, with area sales managers and territory managers acting as enablers to help with fast execution in the field and with onboarding local partners across Pakistan. The movement restrictions imposed during the first phase of the lockdown proved to be a challenge for Reckitt Benckiser and all the CPG businesses surveyed by Profit, which impeded time taken to make deliveries.

“We are experiencing a month over month growth in in-market sale, selling out from the platforms, new partner onboarding, [and have seen] a wave of new ecom platforms,” he said. “The introduction of Now Commerce [gives us] 30 mins to two hour delivery [times]. [We rely on] Jaldisaman, Cheetey, and [Pandamart]. The surge in eCommerce will not be temporary. There will be a huge section of the buyers who will continue purchasing through eCommerce because of a positive consumer experience they have received. This includes, convenience, better assortment and better prices.”

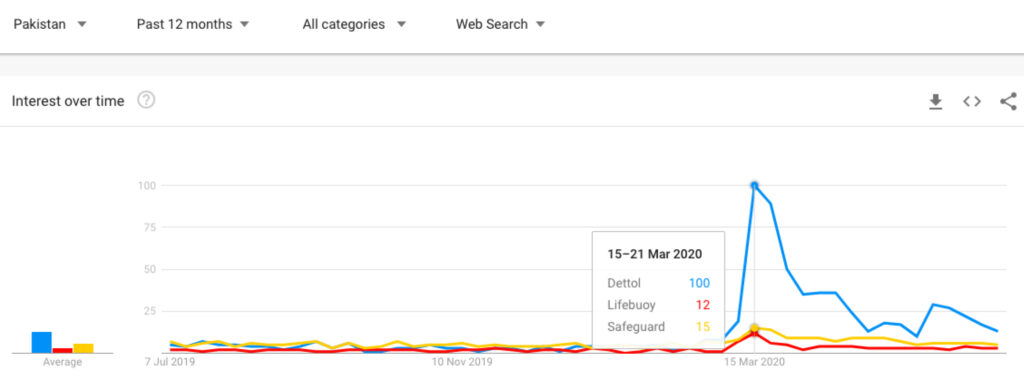

In terms of organic customer acquisition with eCommerce and sales conversions, Hasan told Profit that in-platform search, Facebook, and the branded websites for both Dettol and Veet – both of which redirect interested to buyers to Daraz – helped the business in discoverability, consideration, and conversion across the buyer decision journey. As expected, Hasan said the business noticed a huge surge in searches for Dettol after C19 – a claim confirmed by Google Trends – with Dettol Antiseptic Liquid ranking in the top five branded search terms after C19 according to the latest eCommerce index from Daraz.

“We have our own dedicated e-com FB page “Rbazaar” through which we acquire new customers, also we have a Facebook shop and shop now button on each brand page,” he said. ‘We have two brand websites [for] Dettol & Veet each having an eCommerce leg integration with specific shops now linking, which redirects the customer to our eCommerce store – with Dettol being the hour of the need the website has helped us in an upsurge in organic traffic and acquisition.”

In terms of paid customer acquisition with eCommerce and sales conversions, Hasan told https://www.youtube.com/watch?v=8lZrJHfvTjw that Facebook Collaborative Ads, Google Shopping Ads, and Instagram helped the business acquire new customers and in growing page views. He said that there is no slowdown in demand for products across the Reckitt Benckiser portfolio in Pakistan as far as eCommerce is concerned, adding that the closure of salons has meant that beauty products such as Veet grew in demand as well.

L’Oreal

Within days of the lockdown, L’Oreal tripled down on its eCommerce business unit with deals with marketplaces and e-tailors such as Naheed, Vegas, Saloni, Daraz, and many more similar businesses.

“LOreal has always been pro digital and ecommerce,” said sources within the company. “Brands like NYX are only sold on digital. [After the C19 lockdown], deliveries were a huge challenge due to reliance on marketplaces and e-tailers which are not known for their prompt deliveries. We shifted major spending towards Facebook and influencer marketing, driving conversions through both. The make-up and skincare categories are performing really well, with nearly PKR 50 million worth of the former selling out in Ramadan alone through eCommerce [purchase paths].”

Sources at both L’Oreal Pakistan and Cosmo Group – an international cosmetics brand importer & distributor that competes with L’Oreal Pakistan – shared that the proliferation of counterfeit or fake products listed on Daraz is an epidemic that has not been resolved, adding that now communications on the platform need to add the “please only shop products that have Daraz Mall tag” on them. Respondents from both cosmetics companies shared the slow response from the Alibaba-owned marketplace in improving the vetting of its self-registered sellers is cause for investing in an owned eCommerce platform. They wished Daraz with mirror eBay and Amazon with checks for counterfeit products.

Top three complaints CPG companies have about online marketplaces and e-tailers

Sources at Unilever and Nestle lamented that Daraz, HumMart, and its competitors in the online marketplace and logistics ecosystem were taking advantage of the C19 situation on a couple of fronts. Of the three common complaints, two have merit due to multiple customer complaints across social media that point to symptoms of imperfect end to end customer experience and scenario planning capabilities. Spokespersons of both Daraz and HumMart, who spoke to Profit, refuted and minimized the allegations. There is one complaint, however, that Profit considers to be invalid because it demonstrates a lack of understanding of the online marketplace business model.

The first of the valid complaints are that online marketplace companies do not share data on the customer profile. This includes: who is the buyer, what did they come looking for, which traffic source did they come from, and what time of the day is conversion traffic the highest. The second complaint is that both companies have poor hygiene standards for both their websites and their warehouses, with sources keening about everything from missing images on listings, wrong product descriptions, and delivering expired stock to consumers. The absence of corrective actions by online marketplaces and e-tailers has driven many CPG marketers that spoke to Profit, towards Brandverse, an eCommerce infrastructure provider for product cataloguing and for deploying an online store with application programming interfaces (APIs) for delivery services such as Bykea, Airlift, and Careem.

The third complaint is one which Profit does not agree with because it shows that the eCommerce teams at Nestle and Unilever do not understand the various facets of the revenue models at online marketplaces. In a forecast from 2017, this reporter said that Amazon’s advertising business is worrying the duopoly – Google and Facebook – for eating performance marketing budgets. Within a year later, the prediction came true, with Amazon’s share of performance marketing spending rivaling that of the duopoly. Similarly, Alibaba Group has an advertising business that charges brands that are listed – and even those that are not listed on its platform – for placing ads (even those that redirect to owned dot coms) on its paid, earned, shared, and owned (PESO) digital real estate. This includes and is not limited to the main site, the app, the daily newsletter, and the social media accounts which have grown due to a paid investment over decades.

It is this fundamental misunderstanding of the various business model avenues of the online marketplace model that has created the third complaint – that the leading players in online marketplace charge brands for any visibility on the homepage, on the newsletter, or on social media. Sources at Nestle and Unilever shared that their eCommerce teams were being told they would either be expected to chip in half the cost of running ads on paid, owned, or earned platforms by the marketplaces or expected to return to the negotiation table and offer deeper discounts. The eCommerce teams at Nestle and Unilever expect to have a brand presence across various prime digital real estate, regardless of its placement across the PESO model, while anticipating marketplaces will oblige without asking for anything in return.

Amazing insights !

Yes. I agree

You can’t differentiate with customer experience. PR plays are a risky investment with a very high fail rate. Engagement on social media isn’t necessarily meaningful engagement with your brand. Going viral doesn’t necessarily grow your brand. Interrupting people with ads may do more harm than good. The number of ad impressions is not the number of people impressed. CPG executives need to exit 2015 and create their own platform yesterday.

Great insight